United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Under Rule 14a-12 |

AQUA METALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials: |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

April 4, 2023

Dear Stockholder:

You are cordially invited to attend the 2023 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), to be held at 9:00 a.m. local time, on Thursday, May 18, 2023.

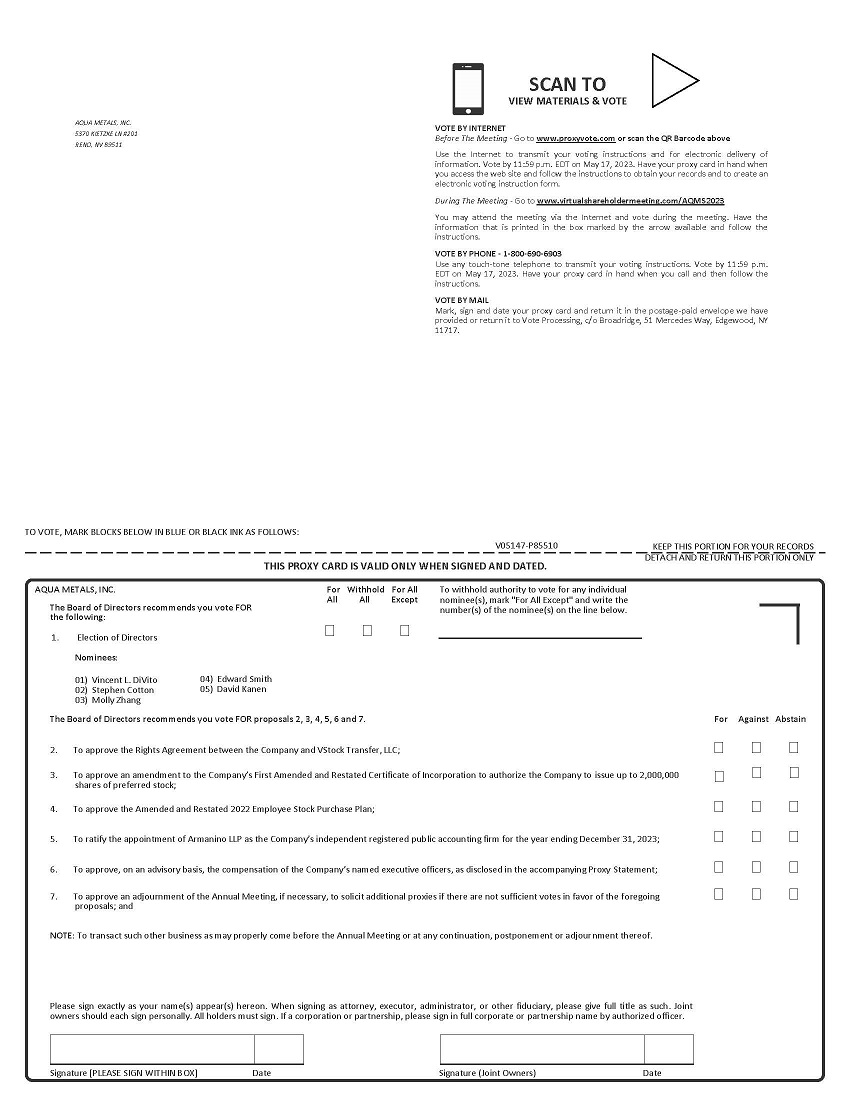

At the Annual Meeting, you will be asked to consider and vote upon the following proposals to: (1) elect five (5) directors to serve for the ensuing year as members of the Board of Directors of the Company; (2) approve the Rights Agreement between the Company and VStock Transfer, LLC; (3) approve an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock; (4) approve the Amended and Restated 2022 Employee Stock Purchase Plan; (5) ratify the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; (6) approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement; (7) approve an adjournment to the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals; and (8) transact such other business as may properly come before the Annual Meeting or at any continuation, postponement or adjournment thereof. The accompanying Proxy Statement describe these matters in more detail. We urge you to read this information carefully.

The Board of Directors recommends a vote: FOR each of the five (5) nominees for director named in the Proxy Statement, FOR the approval of the Rights Agreement between the Company and VStock Transfer, LLC, FOR the approval of an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock, FOR the approval of the Amended and Restated 2022 Employee Stock Purchase Plan, FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement, and FOR an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals.

Whether or not you attend the Annual Meeting, and regardless of the number of shares of Aqua Metals, Inc. that you own, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to vote your shares of common stock via the Internet or by promptly marking, dating, signing, and returning the proxy card via mail or fax. Voting over the Internet, or by written proxy, will ensure that your shares are represented at the Annual Meeting.

On behalf of the Board of Directors of Aqua Metals, Inc., we thank you for your participation.

|

Sincerely, |

|

| /s/ Vincent L. DiVito | |

|

Vincent L. DiVito |

|

|

Chairman of the Board |

AQUA METALS, INC.

5370 Kietzke Lane, #201

Reno, Nevada 89511

(775) 525-1936

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON May 18, 2023

The 2023 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), will be at 9:00 a.m. local time, on Thursday, May 18, 2023.

This year’s meeting is a virtual stockholder meeting conducted exclusively via a live audio webcast at www.virtualshareholdermeeting.com/AQMS2023. Stockholders will be able to attend and listen to the Annual Meeting live, submit questions and vote their shares electronically at the Annual Meeting from virtually any location around the world. In order to attend and vote at the Annual Meeting, please follow the instructions in the section titled “How to Attend” on page 1. We will consider and act on the following items of business at the Annual Meeting:

|

1. |

To elect five (5) directors to serve as members of the Board of Directors of the Company (which we refer to as our “Board”) until the next annual meeting of stockholders and until their successors are duly elected and qualified. The director nominees named in the Proxy Statement for election to our Board are: Vincent L. DiVito, Stephen Cotton, Molly P. Zhang, Edward Smith and David Kanen; |

|

|

|

||

|

2. |

To approve the Rights Agreement between the Company and VStock Transfer, LLC; |

|

|

|

||

|

3. |

To approve an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock; |

|

|

|

||

|

4. |

To approve the Amended and Restated 2022 Employee Stock Purchase Plan; |

|

|

|

||

|

5. |

To ratify the appointment of Armanino LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023; |

|

|

|

||

|

6. |

To approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the accompanying Proxy Statement; |

|

|

|

||

|

7. |

To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals; and |

|

|

|

||

|

8. |

To transact such other business as may properly come before the Annual Meeting or at any continuation, postponement or adjournment thereof. |

The accompanying Proxy Statement describes each of these items of business in detail. Only stockholders of record at the close of business on March 20, 2023 are entitled to notice of, to attend, and to vote at, the Annual Meeting or any continuation, postponement or adjournment thereof.

To ensure your representation at the Annual Meeting, you are urged to vote your shares of common stock via the Internet or by promptly marking, dating, signing, and returning the proxy card via mail or fax. Voting instructions are provided on your proxy card. Any stockholder attending the Annual Meeting may vote in person even if he or she previously submitted a proxy. If your shares of common stock are held by a bank, broker or other agent, please follow the instructions from your bank, broker or other agent to have your shares voted.

|

Sincerely, |

|

| /s/ Vincent L. DiVito | |

|

Vincent L. DiVito |

|

|

Chairman of the Board |

Reno, Nevada

April 4, 2023

AQUA METALS, INC.

5370 Kietzke Lane, #201

Reno, Nevada, 89511

(775) 525-1936

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2023

INFORMATION ABOUT THE ANNUAL MEETING

Your proxy is solicited on behalf of the Board of Directors (which we refer to as our “Board”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), for use at our 2023 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) to be held on Thursday, May 18, 2023, at 9:00 a.m. local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this Proxy Statement. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting.

|

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held Via the Internet at www.virtualshareholdermeeting.com/AQMS2023 on Thursday, May 18, 2023, at 9:00 a.m. local time. The Annual Report, Notice of Meeting, Proxy Statement and Proxy Card are available at – www.proxyvote.com |

We intend to mail this Proxy Statement, the proxy card and the Notice of Annual Meeting on or about April 6, 2023 to all stockholders of record entitled to vote at the Annual Meeting. If you would like a hard copy of the Annual Report, Notice of Meeting, Proxy Statement and Proxy Card for this Annual Meeting, or any future stockholder meetings, mailed or emailed to you, please contact us at the above address or at our web page https://www.aquametals.com/contact-us/ or email us at AQMS@fnkir.com or telephone us at (646) 878-9204.

You are entitled to attend and participate in the Annual Meeting if you were a stockholder as of the close of business on March 20, 2023, the record date, or hold a valid proxy for the meeting. To attend the Annual Meeting, you must access the meeting website at www.virtualshareholdermeeting.com/AQMS2023 and a 16 digit control number is needed to enter the meeting. In order to participate in the virtual meeting, including to vote, ask questions and to view the list of registered stockholders as of the record date during the meeting, you must access the meeting website at www.virtualshareholdermeeting.com/AQMS2023 and have the 16 digit control number found on your proxy card. The meeting webcast will begin promptly at 9:00 a.m. local time. Online check-in will begin approximately 15 minutes before then and we encourage you to allow ample time for check-in procedures.

Who Can Vote, Outstanding Shares

Record holders of our common stock as of the close of business on March 20, 2023, the record date for the Annual Meeting, are entitled to vote at the Annual Meeting on all matters to be voted upon. As of the record date, there were 82,367,210 shares of our common stock outstanding, each entitled to one vote.

You may vote by attending the Annual Meeting or you may vote prior to the Annual Meeting through the Internet or by submitting a proxy. The method of voting differs for shares held as a record holder and shares held in “street name.”

If you are a stockholder of record, which means your shares are in your name, you may vote your shares as follows:

|

● |

To vote in person, attend the Annual Meeting and follow the procedures set forth in "Voting at the Meeting", below. |

|

|

● |

To vote through the Internet, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the control number on the proxy card delivered to you. Your Internet vote must be received by 11:59 p.m., Eastern Time on May 17, 2023 to be counted. |

|

|

● |

To vote using the proxy card delivered to you, simply complete, sign, and date the proxy card and return it promptly in the envelope provided or use a touch-tone telephone to transmit your voting instructions by calling 1-800-690-6903. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

If you hold your shares of common stock in street name, which means that your shares are held of record by a broker, bank or other nominee, you will receive instructions from your broker, bank or other nominee on how to vote your shares by either (i) attending the Annual Meeting and voting in person; (ii) through the Internet; or (iii) otherwise instructing the broker, bank or other nominee on how to vote your shares. Please note that if you hold your shares of common stock in street name, in order to vote your shares in person at the Annual Meeting, you will need to obtain from your broker, bank or other nominee, a valid legal proxy from your broker, bank or other nominee authorizing you to vote your shares at the Annual Meeting.

Additional information regarding the rules and procedures for participating in the Annual Meeting will be provided at the meeting website.

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy or vote through the Internet even if you plan to attend the Annual Meeting. If you properly give your proxy or vote through the Internet, one of the individuals named as your proxy will vote your shares as you have directed. Any stockholder attending the Annual Meeting may vote in person even if he or she previously submitted a proxy or voted through the Internet prior to the Annual Meeting.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically and in writing) received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted as follows:

|

● |

FOR each of the five (5) nominees for director named in the Proxy Statement, and |

|

● |

FOR the approval of the Rights Agreement between the Company and VStock Transfer, LLC (the "Rights Agreement"); |

|

● |

FOR the approval of an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock; |

|

● |

FOR the Amended and Restated 2022 Employee Stock Purchase Plan |

|

● |

FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023, and |

|

● |

FOR the approval, on an advisory basis, of the compensation of the Company’s named executive officers, as disclosed in this Proxy Statement, and |

|

● |

FOR an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals. |

With respect to any other matter that properly comes before the Annual Meeting or any continuation, postponement or adjournment thereof, the proxy holders will vote as recommended by our Board, or if no recommendation is given, in their own discretion.

If you are a stockholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

|

● |

delivering to our corporate secretary a signed written notice of revocation, bearing a date later than the date of the proxy, stating that the proxy is revoked; |

|

|

● |

signing and delivering a new proxy card, relating to the same shares and bearing a later date than the original proxy card; |

|

|

● |

submitting another proxy over the Internet (your latest Internet voting instructions are followed); or |

|

|

● |

attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. |

Written notices of revocation and other communications with respect to the revocation of Company proxies should be addressed to:

Aqua Metals, Inc.

5370 Kietzke Lane, #201

Reno, Nevada 89511

Attention: Corporate Secretary

If your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so.

The inspector of elections appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. The inspector of elections will also determine whether a quorum is present. In order to constitute a quorum for the conduct of business at the Annual Meeting, a majority in voting power of all of the shares of the stock entitled to vote at the Annual Meeting must be present in person or represented by proxy at the Annual Meeting. Shares that abstain from voting on any proposal, or that are represented by broker non-votes (as defined below), will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum is present. However, our Third Amended and Restated Bylaws provide that “votes cast” shall exclude abstentions and broker non-votes.

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank, or other agent how to vote your shares, your broker, bank, or other agent may still be able to vote your shares at its discretion. In this regard, under the rules of the New York Stock Exchange, or NYSE, brokers, banks, and other securities intermediaries that are subject to NYSE rules may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. When a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

We believe that the election of directors (Proposal 1), the approval of the Rights Agreement (Proposal 2), the approval of an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock (Proposal 3), the approval of the Amended and Restated 2022 Employee Stock Purchase Plan (Proposal 4) and the advisory vote on compensation (Proposal 6) will be considered non-routine matters and broker non-votes will not be counted as votes cast. We believe that the ratification of the appointment of Armanino LLP as our independent registered public accounting firm (Proposal 5) and the proposal to adjourn the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1 through 6 (Proposal 7) will be considered to be routine matters on which a broker, bank or other agent has discretionary authority to vote.

Proposal No. 1: Election of Directors. A plurality of the votes cast by the holders of shares entitled to vote in the election of directors at the Annual Meeting is required for the election of directors. Accordingly, the five (5) director nominees receiving the highest number of votes will be elected. Abstentions and broker non-votes are not treated as votes cast and, therefore, will not have any effect on the outcome of the election of directors.

Proposal No. 2: Approval of the Rights Agreement. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval of the Rights Agreement between the Company and VStock Transfer, LLC. In the event of any broker non-votes or abstentions in connection with Proposal No. 2, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 3: Approval of an Amendment to the Company’s First Amended and Restated Certificate of Incorporation. The affirmative vote of a majority of the shares of the Company’s common stock issued and outstanding as of the record date is required for the approval of an amendment to the Company’s First Amended and Restated Certificate of Incorporation to authorize the Company to issue up to 2,000,000 shares of preferred stock. Abstentions and broker non-votes will be treated as shares that are present or represented and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of Proposal No. 3. Thus, abstentions and broker non-votes will have the effect of negative votes on Proposal No. 3.

Proposal No. 4: Approval of the Amended and Restated 2022 Employee Stock Purchase Plan. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval of the Amended and Restated 2022 Employee Stock Purchase Plan. In the event of any broker non-votes or abstentions in connection with Proposal No. 4, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 5: Ratification of Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Abstentions will not be counted as not present and these shares will be deducted from the total shares of which a majority is required. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm and, therefore, broker non-votes are generally not expected to result from the vote on Proposal No. 5. However, in the event of any broker non-votes in connection with Proposal No. 5, such broker non-votes will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 6: Approval, on an Advisory Basis, of the Compensation of the Company’s Named Executive Officers. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in this Proxy Statement. In the event of any broker non-votes or abstentions in connection with Proposal No. 6, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 7: Approval to Adjourn the Annual Meeting. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1 through 6. In the event of any broker non-votes or abstentions in connection with Proposal No. 7, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

We will also consider any other business that properly comes before the Annual Meeting, or any adjournment or postponement thereof. As of the record date, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named as your proxy will vote the shares as recommended by our Board, or if no recommendation is given, in their own discretion.

Our Board is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of soliciting proxies from our stockholders. In addition to the solicitation of proxies by delivery of this Proxy Statement through the Internet or by mail, we will request that brokers, banks and other nominees that hold shares of our common stock, which are beneficially owned by our stockholders, forward proxies and proxy materials to those beneficial owners and secure those beneficial owners’ voting instructions. We will reimburse those record holders for their reasonable expenses. We may use several of our regular employees, who will not be specially compensated, to solicit proxies from our stockholders, either personally or by Internet, facsimile or special delivery letter.

We have retained Morrow Sodali, LLC, a proxy solicitation firm, to perform various solicitation services via phone and email in connection with the Annual Meeting. We will pay Morrow Sodali a fee not to exceed $5,500, plus phone and other related expenses, in connection with its solicitation services.

A list of stockholders eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual Meeting, at the Annual Meeting and at principal executive office of the Company during regular business hours for a period of no less than ten (10) days prior to the Annual Meeting.

This Proxy Statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our 2022 Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

ELECTION OF DIRECTORS

Our Board currently consists of five (5) members, four (4) of whom are independent under the listing standards for independence of the NASDAQ and under Rule 10A-3 under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”). During 2022, our Board consisted of our five current directors, except that David Kanen did not join our Board until August 2022 and S. Shariq Yosufzai, who joined our Board in May 2018, retired from our Board in June 2022. Based upon the recommendation of the Nominating and Corporate Governance Committee of our Board, our Board determined to nominate each of the Company’s current directors for re-election at the Annual Meeting.

Our Board and the Nominating and Corporate Governance Committee believe the directors nominated collectively have the experience, qualifications, attributes and skills to effectively oversee the management of the Company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing the Company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interests of the Company and our stockholders and a dedication to enhancing stockholder value.

Each director elected at the Annual Meeting will serve a one (1) year term until the Company’s next annual meeting and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Unless otherwise instructed, the proxy-holders will vote the proxies received by them for the five (5) nominees named below. If any of the nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board to fill the vacancy. It is not presently expected that any of the nominees named below will be unable or will decline to serve as a director. If additional persons are nominated for election as directors, the proxy-holders intend to vote all proxies received by them in a manner to assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxy-holders.

Set forth below are the names, ages and positions of our director nominees as of the date of this Proxy Statement:

|

Name |

Age |

Position with the Company |

||

|

Stephen Cotton |

56 |

President and Chief Executive Officer |

||

|

Vincent L. DiVito (a), (b), (c) |

63 |

Chairman of the Board and Independent Director |

||

|

Molly P. Zhang (a), (b), (c) |

61 |

Independent Director |

||

|

Edward Smith (a), (b), (c) |

60 |

Independent Director |

||

|

David Kanen (b) |

57 |

Independent Director |

(a) Member of the Audit Committee of our Board.

(b) Member of the Compensation Committee of our Board.

(c) Member of the Nominating and Corporate Governance Committee of our Board.

OUR BOARD RECOMMENDS A VOTE “FOR” EACH OF THE FIVE (5) NOMINEES

FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

Vacancies on our Board, including any vacancy created by an increase in the size of our Board, may be filled by a majority of the directors remaining in office (even though less than a quorum of our Board) or a sole remaining director, or by the stockholders. A director elected by our Board to fill a vacancy will serve until the next annual meeting of stockholders and until such director’s successor is elected and qualified, or until such director’s earlier retirement, resignation, disqualification, removal or death.

If any nominee should become unavailable for election prior to the Annual Meeting, an event that currently is not anticipated by our Board, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by our Board. Each nominee has agreed to serve if elected and our Board has no reason to believe that any nominee will be unable to serve.

Information about Director Nominees

Set forth below is biographical information for each director nominee and a summary of the specific qualifications, attributes, skills and experiences which led our Board to conclude that each nominee should serve on our Board at this time. There are no family relationships among any of the directors or executive officers of the Company.

Vincent L. DiVito has served as a member of our Board since May 2015 and has served as our non-executive Chairman of the Board since June 2022. Since April 2010, Mr. DiVito has served as the owner and chief executive officer of Vincent L. DiVito, Inc., a financial and management consulting firm. From January 2008 to April 2010, Mr. DiVito served as president of Lonza America, Inc., a global life sciences chemical business headquartered in Allendale, New Jersey, and also served as chief financial officer and treasurer of Lonza America, Inc. from September 2000 to April 2010. Lonza America, Inc. is part of Lonza Group, whose stock is traded on the Swiss Stock Exchange. From 1990 to September 2000, Mr. DiVito was employed by Algroup Wheaton, a global pharmaceutical and cosmetics packaging company, first as its director of business development and later as its vice president and chief financial officer. Mr. DiVito is a certified public accountant, certified management accountant and holds an MBA in Finance. Mr. DiVito is a National Association of Corporate Directors Board Leadership Fellow. He served on the board of directors and chairman of the audit committee of Entertainment Gaming Asia Inc., a Nasdaq listed gaming company, from October 2005 until its acquisition in July 2017, and also served as a member of the board of directors of Riviera Holdings Corporation, formerly an AMEX listed gaming and resort company, from July 2002 until the consummation of a change in control of the corporation in March 2011.

Mr. DiVito has extensive knowledge of accounting and corporate governance issues from his experience serving on various corporate boards of directors and has extensive operational knowledge as a result of his experience as a senior executive officer of major corporations. As a result of these and other professional experiences, our Board has concluded that Mr. DiVito is qualified to serve as a director.

Stephen Cotton has served as President of the Company since May 2, 2018 and was promoted by the Board of Directors to President and CEO joining the Board as an Executive Director in January, 2019. Steve also served as Chief Commercial Officer of the Company from January 2015 to June, 2017. Previously, Steve co-founded Canara, Inc. (formerly Data Power Monitoring and IntelliBatt) in December 2001 and served as its Chief Executive Officer through the sale of the company to a private equity firm in June 2012, after which he served as Founder and Executive Chairman until April 2014. Canara (now part of CPG Data Center Innovators) is a global provider of stationary battery systems with integrated monitoring systems and cloud-based monitoring services to many of the largest data center operators. Prior to Canara, Steve led a team to commercialize Sendmail (the Worlds' most commonly used Internet email open source software) from free open source to a paid for commercial offering for Internet service providers and cloud offerings requiring mass email volume management including DoubleClick's standardization (acquired by Google). Steve's career began in the early days of voice messaging systems, including Octel Communications (through its $1.1B exit to Lucent Technologies in 1997 and now part of Avaya). From International Product Manager, to Product Manager for Multimedia, Steve then became the top market development person on a staff of 100+ for 2 years running while managing the AT&T Wireless account, then developing new wireless and local exchange carrier markets. His decision to convince AT&T Wireless (and ultimately other operators which followed) to offer voice messaging for free vs. charge, resulted in multi-million dollar sales of Octel equipment to each region. From April 2014 to January 2015 and June 2017 to April 2018, Steve managed his private investments.

Molly P. Zhang (also known as Peifang Zhang) has served as a member of our Board since March 2021. Prior to her transition to board services, Ms. Zhang served in various global leadership positions with Orica (ASX: ORI), a global mining services company, from 2011 to 2016, most recently as Vice President of Asset Management from 2015 to 2016. Ms. Zhang also served in various senior leadership positions with Dow Inc. ( NYSE: DOW) from 1989 to 2009, most recently as Managing Director, SCG-Dow Group from 2009 to 2011 and as Business Vice President for Dow's Global Technology Licensing and Catalyst business from 2006 to 2009. Ms. Zhang is currently on the boards of Enerkem, Gates Industrial Corporation ( NYSE: GTES), Arch Resources (NYSE: Arch) and Recology.

Ms. Zhang has extensive international business, operational and financial management experience, as well as services on various corporate boards of directors. As a result of these and other professional experience, our Board has concluded that Ms. Zhang is qualified as a director.

Edward Smith has served as a member of our Board since March 2021. Mr. Smith has served as President and Chief Executive Officer, and as a member of the board of directors, of SMTC Corporation (NASDAQ: SMTX) since February 2017. Mr. Smith has extensive experience in the electronic manufacturing services, or EMS, industry and the electronic components distribution industry. He served as a member of the board of advisors of Zivelo, Inc., a position he held from 2015 to 2019. Most recently, Mr. Smith served as Senior Vice President of Global Embedded Solutions at Avnet, Inc. during 2016 and as President of Avnet Electronics Marketing Americas from February 2009 to March 2016. Mr. Smith worked in many positions during his tenure at Avnet, Inc., which began in 1994. From 2002 to 2004, Mr. Smith served as President and Chief Executive Officer of SMTEK International, Inc., a tier II manufacturer in the EMS industry. From 2009 to 2017, Mr. Smith served as a board member of the Electronic Components Industry Association. Mr. Smith is also the founder and Chief Executive Officer of We Will Never Forget Foundation, Inc., a nonprofit organization that supports first responders through gifts to other charitable organizations.

Mr. Smith has extensive managerial, operational and financial experience, as well as service on various corporate boards of directors. As a result of these and other professional experiences, our Board has concluded that Mr. Smith is qualified to serve as a director.

David Kanen has served as a member of our Board since August 2022. Mr. Kanen founded Wealth Management in 2016 and has served as its President and Portfolio Manager since inception. Mr. Kanen has 34 years of investment experience. From 1988 to 2012, Mr. Kanen worked for several brokerage firms as both an institutional and retail advisor. From 1992 to 2004, Mr. Kanen worked as a wealth manager/broker with A.G. Edwards & Sons, Inc., where he served both retail and institutional clients, including hedge funds, that focused on value investing. Mr. Kanen is the President and Portfolio Manager of Kanen Wealth Management, LLC and Philotimo Fund, L.P. Located in Coral Springs, Florida, the firm provides portfolio construction and market-responsive investment management strategies. Its investment philosophy is rooted in value-based investing. Mr. Kanen graduated from Jacksonville University with a B.A. in Marketing in 1988.

Mr. Kanen has extensive investment, managerial and financial experience, as well as service on various corporate boards of directors. As a result of these and other professional experiences, our Board has concluded that Mr. Kanen is qualified to serve as a director.

Our Board may establish the authorized number of directors from time to time by resolution. Our Board currently consists of five (5) authorized members. During the year ended December 31, 2022, our Board met six times. All of our Board members attended at least 75% of the aggregate of all Board meetings and all meetings of the Board committees upon which they served while they were on the Board during fiscal 2022 Our Board does not have a policy regarding Board members’ attendance at meetings of our stockholders and four member of our Board attended our prior year’s annual meeting of stockholders.

Generally, under the listing requirements and rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s board of directors. Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Our Board has determined that, other than Mr. Cotton, by virtue of his executive officer position, none of our director nominees has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making this determination, our Board considered the current and prior relationships that each nonemployee director nominee has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each nonemployee director nominee. Accordingly, a majority of our directors are independent, as required under applicable Nasdaq Stock Market rules, as of the date of this Proxy Statement.

On September 21, 2018, the Board adopted the Director Resignation Policy, whereby, commencing with respect to our 2020 annual meeting (and at each subsequent annual meeting of the Company’s stockholders at which directors of the Company are to be elected), any director who fails to receive a majority of the votes cast by the Company’s stockholders at such meeting “for” his or her election as a Company director immediately shall (after the final tabulation and certification by the Company’s inspector of elections of voting results), tender his or her resignation to the Nominating and Corporate Governance Committee or Nominating Committee, for its consideration and acceptance or rejection.

The Board adopted the Director Resignation Policy to address the situation in which a nominee for the Board is elected to the Board in an uncontested election despite receiving more votes “withheld” from or “against” his or her election than votes “for” his or her election (a “majority withheld vote”). For purposes of the policy, an “uncontested election” is any election of Company directors in respect of which the number of director nominees for election is less than or equal to the number of directors to be elected.

By accepting a nomination for election and agreeing to serve as a director of the Company in any uncontested election of Company directors, each nominee agrees that if he or she receives a majority withheld vote in any such election, such director promptly shall tender to the Board an offer of his or her resignation as a Company director following certification of the stockholder vote by the inspector(s) of election at the meeting for such uncontested election. Any director who offers his or her resignation pursuant to this policy will not participate in any discussions, deliberations or actions by either the Nominating Committee or the full Board with respect to his or her own resignation offer, but will otherwise continue to serve as a director unless and until such resignation is accepted and effective.

The Nominating Committee will duly consider and recommend to the full Board whether to accept or reject the resignation offer received from each director who received a majority withhold vote. Following the recommendation of the Nominating Committee, the independent members of the Board will make a determination of the action to take with respect to the offer of resignation, not later than the 90th day immediately succeeding the date of the written certification of the shareholder vote by said inspector(s) of election. The Nominating Committee and the Board will evaluate any such tendered offer of resignation, in accordance with their fiduciary duties to, and in furtherance of the best interests of, the Company and its stockholders. The Board may accept or reject the offer of resignation, or it may decide to pursue additional actions, including, without limitation, the following:

|

● |

allow the director to remain on the Board and continue to serve but not be nominated for re-election to the Board at the next election of directors; |

|

● |

defer the acceptance of the resignation until the director vacancy the resignation will create can be filled by the Board with a replacement/successor director meeting all the necessary qualifications and criteria for Company directors and/or satisfying other legal and regulatory requirements with respect to the composition of the Board (for purposes of illustration, such as “independence” requirements established by Securities and Exchange Commission regulations or securities exchange listing requirements); or |

|

● |

defer the acceptance of the resignation if it is determined that the underlying cause of the majority withheld vote can be cured by the director or otherwise within a specified period of time (for purposes of illustration, if the majority withhold vote was due to the relevant director receiving such vote serving on the board of directors of another entity, by resigning from such other board). |

The Board’s decision will be disclosed in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission within four business days after the decision. If the Board has decided to reject the tendered resignation, or to pursue any additional action other than accepting the tendered resignation (as described above or otherwise), then the Current Report on Form 8-K will fully disclose the Board’s reasons for doing so.

Committees of the Board of Directors

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Our Board may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each of our committees operates under a written charter, a copy of which is available at our investor relations website located at https://ir.aquametals.com.

Our Audit Committee currently consists of consists of Vincent L. DiVito, Edward Smith and Molly P. Zhang, with Mr. DiVito serving as Chairperson. The composition of our Audit Committee meets the requirements for independence under current Nasdaq Stock Market listing standards and SEC rules and regulations. Each member of our Audit Committee meets the financial literacy requirements of the Nasdaq Stock Market listing standards. Mr. DiVito is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended, or the Securities Act. Pursuant to its charter, our Audit Committee will, among other things:

|

● |

select a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

|

|

● |

discuss the scope and results of the audit with the independent registered public accounting firm, and review, with management and the independent registered public accounting firm, our interim and year-end operating results; |

|

|

● |

develop procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

|

|

● |

review our policies on risk assessment and risk management; |

|

|

● |

review related-party transactions; and |

|

|

● |

approve (or, as permitted, pre-approve) all audit and all permissible nonaudit services, other than de minimis nonaudit services, to be performed by the independent registered public accounting firm. |

Our Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market. During the year ended December 31, 2022, our Audit Committee met 4 times.

Our Compensation Committee currently consists of Edward Smith, Vincent L. DiVito, David Kanen and Molly P. Zhang, with Mr. Smith serving as Chairperson. The composition of our Compensation Committee meets the requirements for independence under the Nasdaq Stock Market listing standards and SEC rules and regulations. Each member of the Compensation Committee is also a nonemployee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, as amended. The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Pursuant to its charter, our Compensation Committee will, among other things:

|

● |

review, approve and determine the compensation of our executive officers; |

|

|

● |

administer our stock and equity incentive plans; |

|

|

● |

make recommendations to our Board regarding director compensation and the establishment and terms of incentive compensation and equity plans; and |

|

|

● |

establish and review general policies relating to compensation and benefits of our employees. |

Our chief executive officer may, from time to time, provide input and recommendation to our Compensation Committee concerning the compensation of our other executive officers. Our chief executive officer may also, from to time, attend Compensation Committee meetings, but he is not present during the Committee’s deliberations regarding executive officer compensation. From time to time, our Compensation Committee may use an independent consultant in considering compensation policies and programs for executive officers, our Compensation Committee did not engage an independent consultant during fiscal 2022. However, during 2023 our Compensation Committee directed management to retain Pay Governance LLC, a compensation consulting firm, to review and make recommendations concerning the overall compensation of our named executive officers, including severance benefits, along with the structure and terms of our Amended and Restated 2022 Employee Stock Purchase Plan. Our Compensation Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market. During the year ended December 31, 2022, our Compensation Committee met 4 times.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of Molly P. Zhang, Vincent L. DiVito, and Edward Smith, with Ms. Zhang serving as Chairperson. The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under Nasdaq Stock Market listing standards and SEC rules and regulations. Pursuant to its charter, our Nominating and Corporate Governance Committee will, among other things:

|

● |

identify, evaluate and make recommendations to our Board regarding nominees for election to our board of directors and its committees; |

|

|

● |

evaluate the performance of our Board and of individual directors; |

|

|

● |

consider and make recommendations to our Board regarding the composition of our Board and its committees; |

|

|

● |

review developments in corporate governance practices; |

|

|

● |

evaluate the adequacy of our corporate governance practices and reporting; |

|

|

● |

assist in the development of our executive officers; |

|

|

● |

develop and oversee a plan for succession to the position of Chief Executive Officer and other senior management positions; and |

|

|

● |

develop and make recommendations to our Board regarding corporate governance guidelines and matters. |

Our Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age, and having the highest personal integrity and ethics. The committee also considers such factors as diversity, an individual’s business experience and skills, independence, judgment, integrity and ability to commit sufficient time and attention to the activities of the Board, as well as the absence of any potential conflicts with our Company’s interests. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of our company, and the long-term interests of our stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills, and such other factors as it deems appropriate, given the current needs of the Board and our Company, to maintain a balance of knowledge, experience, and capability. Our Nominating and Corporate Governance Committee conducts an annual assessment of the Committee’s charter and the performance of the committee under the charter and the above standards.

Our Nominating and Corporate Governance Committee will consider for directorship candidates nominated by third parties, including stockholders. However, at this time, our Nominating and Corporate Governance Committee does not have a policy with regard to the consideration of director candidates recommended by stockholders. The Nominating and Corporate Governance committee believes that it is in the best position to identify, review, evaluate, and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board. For a third party to suggest a candidate, one should provide our corporate secretary, Judd Merrill, with the name of the candidate, together with a brief biographical sketch and a document indicating the candidate’s willingness to serve if elected.

The Nominating and Corporate Governance Committee operates under a written charter that satisfies the applicable listing requirements and rules of the Nasdaq Stock Market. During the year ended December 31, 2022, our Nominating and Corporate Governance Committee met 5 times.

Board Diversity

The following Board Diversity Matrix presents our Board diversity statistics in accordance with Nasdaq Rule 5606, as self-disclosed by our directors. As we pursue future Board recruitment efforts, our Nominating and Corporate Governance Committee will continue to seek out candidates who can contribute to the diversity of views and perspectives of our Board.

|

Part I: Gender Identity |

Female |

Male |

Non-Binary |

Decline to Disclose |

||||||||||||

|

Directors (5 total) |

1 | 2 | -- | 2 | ||||||||||||

|

Part II: Demographic Background |

Female |

Male |

Non-Binary |

Decline to Disclose |

||||||||||||

|

African American or Black |

-- | -- | -- | -- | ||||||||||||

|

Alaskan Native or Native American |

-- | -- | -- | -- | ||||||||||||

|

Asian |

1 | -- | -- | -- | ||||||||||||

|

Hispanic or Latinx |

-- | -- | -- | -- | ||||||||||||

|

Native Hawaiian or Pacific Islander |

-- | -- | -- | -- | ||||||||||||

|

White |

-- | 2 | -- | -- | ||||||||||||

|

Two or More Races or Ethnicities |

-- | -- | -- | -- | ||||||||||||

|

LGBTQ+ |

-- | -- | -- | -- | ||||||||||||

|

Did Not Disclose Demographic Background |

-- | -- | -- | -- | ||||||||||||

Board Leadership Structure and Role in Risk Oversight

We have adopted a formal policy pursuant to which the chairman and chief executive officer positions shall be separate in order to effectively separate the roles of chairman and chief executive officer. Vincent L. DiVito currently serves as our non-executive Chairman and the lead independent director of the Board. Our Board has an active role in overseeing our areas of risk. While the full Board has overall responsibility for risk oversight, the Board has assigned certain areas of risk primarily to designated committees, which report back to the full Board.

Process for Stockholders to Send Communications to our Board of Directors

Because we have always maintained open channels of communication with our stockholders, we do not have a formal policy that provides a process for stockholders to send communications to our Board. However, if a stockholder would like to send a communication to our Board, please address the letter to the attention of our corporate secretary, Judd Merrill, and it will be distributed to each director.

Employee, Officer and Director Hedging

We have adopted a policy that no director, officer, employee or consultant of the Company may engage in any short term or speculative transactions involving securities of the Company. These prohibited speculative transactions include short sales, publicly traded options, hedging transactions, margin accounts and pledged securities, and standing and limit orders.

We have adopted a code of conduct for all employees, including the chief executive officer, principal financial officer and principal accounting officer or controller, and/or persons performing similar functions, which is available on our website, under the link entitled “Code of Conduct”.

Limitation of Liability of Directors and Indemnification of Directors and Officers

The Delaware General Corporation Law provides that corporations may include a provision in their certificate of incorporation relieving directors of monetary liability for breach of their fiduciary duty as directors, provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful payment of a dividend or unlawful stock purchase or redemption, or (iv) for any transaction from which the director derived an improper personal benefit. Our First Amended and Restated Certificate of Incorporation provides that directors are not liable to us or our stockholders for monetary damages for breach of their fiduciary duty as directors to the fullest extent permitted by Delaware law. In addition to the foregoing, our Third Amended and Restated Bylaws provide that we may indemnify directors, officers, employees or agents to the fullest extent permitted by law and we have agreed to provide such indemnification to each of our directors.

The above provisions in our First Amended and Restated Certificate of Incorporation and Third Amended and Restated Bylaws and in the written indemnity agreements may have the effect of reducing the likelihood of derivative litigation against directors and may discourage or deter stockholders or management from bringing a lawsuit against directors for breach of their fiduciary duty, even though such an action, if successful, might otherwise have benefited us and our stockholders. However, we believe that the foregoing provisions are necessary to attract and retain qualified persons as directors.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

RIGHTS AGREEMENT PROPOSAL

The Board is asking stockholders to approve the Rights Agreement between the Company and VStock Transfer, LLC, referred to herein as the Rights Agreement. The Board approved the Rights Agreement on March 14, 2023 and directed that it be submitted for approval by the stockholders at the Annual Meeting. The Board approved the Rights Agreement in an effort to protect stockholder value by attempting to protect against a possible limitation on our ability to use our net operating losses ("NOLs"), and other tax benefits as a result of an “ownership change,” as defined in Section 382 ("§382") of the Internal Revenue Code of 1986, as amended (the "Code"), and rules promulgated thereunder. The Company will not enter into the Rights Agreement if either Proposal No. 2 or Proposal No. 3 is not approved by the stockholders at the Annual Meeting.

Our past operations generated significant NOLs, and we may generate additional NOLs in future years. Under federal tax laws, for NOLs arising in tax years ending before January 1, 2018, we generally can use our NOLs and certain related tax credits to reduce ordinary income tax paid in our prior two tax years or on our future taxable income for up to 20 years, at which point they “expire” for such purposes. Until they expire, we can “carry forward” NOLs and certain related tax credits that we do not use in any particular year to offset taxable income in future years. For NOLs arising in tax years beginning after December 31, 2017, we generally can use any such NOLs and certain related tax credits to reduce ordinary income tax paid on our future taxable income indefinitely, however, any such NOLs cannot be used to reduce ordinary income tax paid in prior tax years. In addition, the deduction for NOLs arising in tax years beginning after December 31, 2017 is limited to 80% of our taxable income for any tax year (computed without regard to the NOL deduction). As of December 31, 2017, we had approximately $25.2 million in federal NOLs which arose in tax years ending before January 1, 2018 (our “Expiring NOLs”).

Our ability to utilize our NOLs to offset future taxable income may be significantly limited by an “ownership change,” as determined under §382 of the Code. Under §382, an “ownership change” occurs when the sum of the maximum percentage increase in ownership for each stockholder owning 5% or more of our common stock at any time during a rolling three-year period is greater than 50 percentage points. When an ownership change occurs, §382 imposes an annual limit on the amount of our NOLs that we can use to offset taxable income equal to the product of the total value of our outstanding equity immediately prior to the ownership change (reduced by certain items specified in §382) and the federal long-term tax-exempt interest rate in effect for the month of the ownership change. A number of complex rules apply to calculating this annual limit.

Once an ownership change is deemed to occur, the limitations imposed by §382 could significantly limit our ability to use our NOLs to reduce future income tax liability and result in a material amount of our Expiring NOLs expiring unused and, therefore, significantly impair the value of our NOLs.

As of December 31, 2022, we estimate that we had U.S. federal and state income tax NOLs of approximately $151.2 million. While we cannot estimate the exact amount of our NOLs that we will be able to use to reduce future income tax liability because we cannot predict the amount and timing of our future taxable income, we believe our NOLs are a very valuable asset and that, if no action is taken to protect our NOLs, we could experience an ownership change for purposes of §382. If such ownership change occurs, our ability to use our NOLs and other tax benefits will be substantially limited. These limitations could require us to pay U.S. federal and state income taxes earlier than would otherwise be required if such limitations were not in effect and could cause the Expiring NOLs and other tax benefits to expire unused, in each case reducing or eliminating the benefit of such NOLs and other tax benefits. Similar rules and limitations may apply for state income tax purposes.

After careful consideration, our Board determined that the most effective way to protect the significant potential long-term tax benefits presented by our NOLs is to adopt the Rights Agreement. On March 14, 2023, the Board approved the Rights Agreement, which is between the Company and VStock Transfer, LLC as the Rights Agent. The Rights Agreement provides for a dividend of one preferred stock purchase right (a “Right”) for each share of our common stock that is outstanding on the tenth day following the effectiveness of the Rights Agreement (the “Record Date”). Each Right entitles the holder to purchase from us one one-thousandth of a share of Series A Junior Participating Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), for a purchase price to be determined by the Board concurrent with the execution of the Rights Agreement (the “Purchase Price”), subject to adjustment as provided in the Rights Agreement. Pursuant to the Rights Agreement, we will issue certain stock purchase rights to stockholders with terms designed to deter certain acquisitions and transfers of our common stock that could result in an ownership change that would limit the utility and value of the NOLs. The description and terms of the Rights are set forth in the form of the Rights Agreement, which is attached to this Proxy Statement as Appendix A.

The Board approved the Rights Agreement with the intention of reducing the likelihood of an ownership change so that the Company could protect and preserve its substantial tax attributes primarily associated with its NOLs under §382. However, we cannot be sure that these measures will be effective in deterring or preventing such an ownership change. You should note that the Rights Agreement does not offer a complete solution and an ownership change may occur even if the Rights Agreement is approved by our stockholders. The Rights Agreement may deter, but ultimately cannot block, transfers of common stock that might result in an ownership change. The limitations of the Rights Agreement are described in more detail below. The information included in this Proxy Statement regarding §382 is a summary only and stockholders should refer to the full text of §382 and the Code and consult with their tax advisor for more information.

Description of the Rights Agreement

The following description of the Rights Agreement is qualified in its entirety by reference to the form of the Rights Agreement, which is attached to this Proxy Statement as Appendix A. We urge you to carefully read the Rights Agreement in its entirety as the discussion below is only a summary.

Effectiveness. The Rights Agreement will become effective shortly after approval of both Proposal No. 2 and Proposal No. 3 (the “Effective Date”). Upon and following the Effective Date, Rights will be issued in respect of all outstanding shares of the Company's common stock that are outstanding on the Record Date, and will be issued for all shares of the Company's common stock that become outstanding after the Record Date and, subject to the next sentence, prior to the earliest of the Distribution Date (as defined below), the redemption of the Rights or the Expiration Date (as defined below).

Term. The Rights will expire on the earliest of (a) the close of business on the three-year anniversary of the date of the Rights Agreement, or such earlier date as of which our Board determines that the Rights Agreement is no longer necessary for the preservation of the tax benefits; (b) the time at which the Rights are redeemed pursuant to the Rights Agreement; (c) the time at which all exercisable Rights are exchanged pursuant to the Rights Agreement; (d) the close of business on the effective date of the repeal of §382 or any successor or replacement provision if our Board determines that the Rights Agreement is no longer necessary for the preservation of the tax benefits; and (e) the close of business on the first day of a taxable year of the Company to which our Board determines that no tax benefits may be carried forward, as more fully set forth in the Rights Agreement (the “Expiration Date”).

Acquiring Person. An “Acquiring Person” is a person, entity or group thereof (a “Person”) who or which, together with all affiliates and associates of such Person, is or becomes the beneficial owner of 4.99% or more of the Company’s then-outstanding shares of common stock, subject to certain exemptions as described in the Rights Agreement.

Exercisability. Initially, the Rights will not be exercisable. The Rights will become exercisable upon the earlier of the following dates (such date, the “Distribution Date”):

|

• |

10 days after a public announcement by the Company or an Acquiring Person that a Person has become an Acquiring Person; and |

|

• |

10 business days (or a later date determined by our Board) after a Person begins a tender or an exchange offer that, if completed, would result in that Person becoming an Acquiring Person. |

Rights may be exercised to purchase shares of our Series A Preferred Stock only after the Distribution Date occurs and prior to the Expiration Date.

Flip-In Event. In the event that a Person or an affiliate or associate of such Person becomes an Acquiring Person (unless the event causing such Person to become an Acquiring Person is a transaction described as a “Flip-Over Event,” as described below or the Rights are exchanged, as described below) each holder of a Right, except the Acquiring Person, may exercise their Right upon payment of the Purchase Price to purchase shares of our common stock (or, in certain circumstances, other securities or assets as determined by the Board) with a market value of two times the Purchase Price. We refer to this as a “Flip-In Event.”

Flip-Over Event. In the event that, at any time after a Person or an affiliate or associate of such Person becomes an Acquiring Person, the Company is acquired in a merger or other business combination transaction or 50% or more of its consolidated assets or earning power are sold, each holder of a Right, except the Acquiring Person, may exercise their Right upon payment of the Purchase Price, to purchase shares of common stock of the acquiring or other appropriate entity with a market value of two times the Purchase Price of the Rights. We refer to this as a “Flip-Over Event.”

Exchange. At any time after any Person becomes an Acquiring Person and prior to the acquisition by such Acquiring Person of 50% or more of the Company's then-outstanding shares of common stock, our Board may exchange each Right (other than Rights owned by such Acquiring Person which will have become null and void) for one share of the Company's common stock or equivalent securities.

Exempt Persons and Exempt Transactions. Prior to someone become an Acquiring Person, the Board can determine that any Person which would otherwise be an Acquiring Person can be exempted from becoming an Acquiring Person or any transaction that would result in someone becoming an Acquiring Person, can be exempted in determining whether someone has become an Acquiring Person. After someone has become an Acquiring Person, the Board’s ability to grant an exemption is generally limited to circumstances where a Person has inadvertently become an Acquiring Person. Before granting an exemption, the Board may require that a Person make certain representations, undertakings or covenants.

Right Certificates and Transferability. Prior to the Distribution Date, the Rights will be evidenced by the certificates for shares of our common stock, and the Rights will be transferable only with the related common stock (or, in the case of uncertificated shares of our common stock, the applicable record of ownership) and will be automatically transferred with any transfer of the related common stock. After the Distribution Date, the Rights will separate from the common stock and be evidenced by separate right certificates (“Right Certificates”), which we will mail to all holders of Rights, except any Acquiring Persons whose Rights will become null and void upon becoming an Acquiring Person. After the close of business on the Distribution Date and prior to the Expiration Date, the Rights may only be transferred, split up, combined, or exchanged upon written request to the Rights Agent and surrender of the Right Certificate.

Terms of Series A Preferred Stock. The terms of the Series A Preferred Stock issuable upon exercise of the Rights are designed so that each 1/1,000th of a share of Series A Preferred Stock is the economic and voting equivalent of one whole share of our common stock. In addition, the Series A Preferred Stock has certain minimum dividend and liquidation rights.

Anti-Dilution Adjustments. The Board may adjust the Purchase Price of the Series A Preferred Stock, the number of shares of Series A Preferred Stock issuable and the number of outstanding Rights to prevent dilution that may occur as a result of certain events, including, among others, a stock dividend, a stock split or a reclassification of the Series A Preferred Stock or our common stock. No adjustments to the Purchase Price of less than one percent will be made.

Redemption. Our Board may redeem all (but not less than all) of the Rights for a redemption price of $0.001 per Right at any time before a Person has become an Acquiring Person. Once the Rights are redeemed, the right to exercise the Rights will terminate, and the only right of the holders of such Rights will be to receive the redemption price. The redemption price will be adjusted if we declare a stock split or issue a stock dividend on our common stock.

Amendment. Before the time a Person has become an Acquiring Person, our Board may amend or supplement the Rights Agreement in any respect without the consent of the holders of the Rights, except that no amendment may decrease the redemption price below $0.001 per Right. At any time, our Board may amend or supplement the Rights Agreement to cure any ambiguity, to correct or supplement any provision of the Rights Agreement which may be defective or inconsistent with any other provisions, to shorten or lengthen any time period or to supplement or amend the provisions of the Rights Agreement in any manner which the Company may deem desirable, but after a Person has become an Acquiring Person only to the extent that those changes do not impair or adversely affect any Rights holder and do not result in the Rights again becoming redeemable. The limitations on our Board’s ability to amend the Rights Agreement does not affect our Board’s power or ability to take any other action that is consistent with its fiduciary duties under applicable Delaware law.

Certain Considerations Relating to the Rights Agreement

The Board believes that attempting to protect the NOLs is in our and the stockholders’ best interests. Nonetheless, we cannot eliminate the possibility that an ownership change will occur even if the Rights Agreement is approved. You should consider the factors below when making your decision.

|

● |

Future Use and Amount of the NOLs Is Uncertain. Our use of the NOLs depends on our ability to generate taxable income in the future. We cannot assure you whether we will have taxable income in any applicable period or, if we do, whether such income or the NOLs at such time will exceed any potential limitation under §382. |

|

● |

Potential Challenge to the NOLs. The amount of the NOLs has not been audited or otherwise validated by the Internal Revenue Service (the “IRS”). The IRS could challenge the amount of the NOLs, which could result in an increase in our liability in the future for income taxes. In addition, determining whether an ownership change has occurred is subject to uncertainty, both because of the complexity and ambiguity of the §382 provisions and because of limitations on the knowledge that any publicly traded company can have about the ownership of, and transactions in, its securities on a timely basis. Therefore, we cannot assure you that the IRS or another taxing authority will not claim that we experienced an ownership change and attempt to reduce the benefit of the NOLs available to us at such time even if the Rights Agreement is in place. |

|

● |

Continued Possibility of Ownership Change. Although the Rights Agreement is intended to diminish the likelihood of an ownership change by deterring (rather than prohibiting) persons or groups of persons from acquiring beneficial ownership of our common stock in excess of the specified limitations, we cannot assure you that it will be effective. The amount by which an ownership interest may change in the future could, for example, be affected by sales of our common stock by stockholders who are 5% shareholders (as defined under §382) or by sales or purchases of stock or other interests in corporations, partnerships or other legal entities that own 5% or more of our common stock, over which we have no control. Additionally, it may be in our best interests, taking into account all relevant facts and circumstances at the time, to permit the acquisition of common stock in excess of the specified limitations or to issue a reasonable amount of equity in the future, all of which may increase the likelihood of an ownership change. |

|

● |

Potential Effects on Liquidity. The Rights Agreement is intended to deter persons or groups of persons from acquiring beneficial ownership of our common stock in excess of the specified limitations. A stockholder’s ability to dispose of our common stock may be limited if the Rights Agreement reduces the number of persons willing to acquire our common stock or the amount they are willing to acquire. A stockholder may become an acquiring person upon actions taken by persons related to, or affiliated with, them. Stockholders are advised to carefully monitor their ownership of our common stock and consult their own legal advisors and/or us to determine whether their ownership of the shares approaches the proscribed level. |

|

● |

Potential Impact on Value. The Rights Agreement could negatively impact the value of our common stock by deterring persons or groups of persons from acquiring our common stock, including in acquisitions for which some stockholders might receive a premium above market value. |

| ● |

Anti-Takeover Effect. The Board adopted the Rights Agreement to diminish the risk that our ability to use the NOLs to reduce potential federal and state income tax obligations becomes limited. Nonetheless, the Rights Agreement may have an “anti-takeover effect” because it may deter a person or group of persons from acquiring beneficial ownership of 4.99% or more of our common stock or, in the case of certain stockholders, from increasing their beneficial ownership of our common stock. The Rights Agreement could discourage or prevent a merger, tender offer, proxy contest or accumulations of substantial blocks of shares. |

Approval of Proposal No. 2 requires the affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting. In the event of any broker non-votes or abstentions in connection with Proposal No. 2, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

OUR BOARD RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE ADOPTION OF THE RIGHTS AGREEMENT.

APPROVE AND ADOPT AN AMENDMENT TO THE COMPANY’S FIRST AMENDED AND

RESTATED CERTIFICATE OF INCORPORATION TO AUTHORIZE THE COMPANY TO ISSUE UP TO 2,000,000 SHARES OF PREFERRED STOCK