Exhibit 99.2

Feb 2017 “ The World’s First Clean Lead Recycling Company” 2016 Q4 and Year End Earnings call NASDAQ: AQMS

Safe Harbor NASDAQ: AQMS This document contains forward - looking statements concerning Aqua Metals, Inc., the lead - acid battery recycling industry, the intended benefits of its agreements with Johnson Controls and Interstate Batteries, the future of lead - acid battery recycling via traditional smelters, the Company’s development of its commercial lead - acid battery recycling facilities and the quality, efficiency and profitability of Aqua Metals’ proposed lead - acid battery recycling operations. Those forward - looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially. Among those factors are: (1) the fact that Company has not yet ramped up its initial commercial recycling facility, to full scale operation thus subjecting the Company to all of the risks inherent in a start - up; (2) the uncertainties involved in any new commercial relationship and the risk that Aqua Metals will not receive the intended benefits of its agreements with Johnson Controls and Interstate Batteries; (3) risks related to Aqua Metals’ ability to raise sufficient capital, as and when needed, to expand its recycling facilities; (4) changes in the federal, stat e and foreign laws regulating the recycling of lead - acid batteries; (5) the Company’s ability to protect its proprietary technology, trade secrets and know - how and (6) these and other risks disclosed in the section “Risk Factors” included in the quarterly report on Form 10 - Q filed with the SEC on November 7, 2016. Aqua Metals cautions readers not to place undue reliance on any forward - looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur. 2

Agenda • Our Vision and Strategy • Status • JCI Agreements • Financials • Summary NASDAQ: AQMS 3

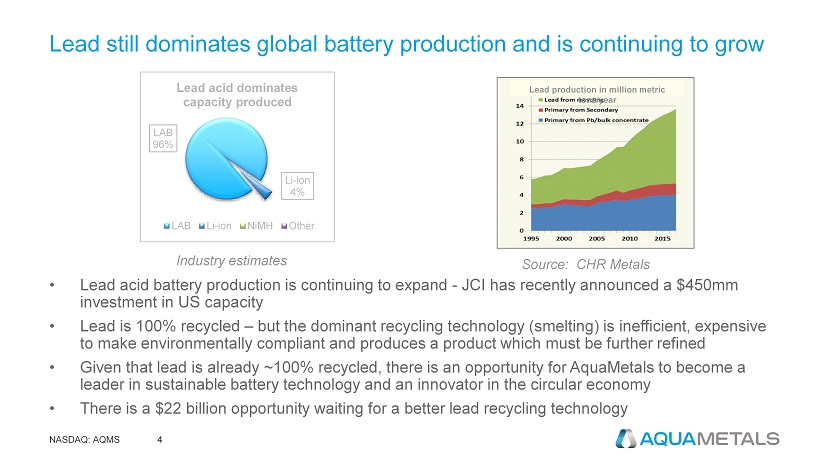

LAB 96% Li - ion 4% Lead acid dominates capacity produced LAB Li-ion NiMH Other Industry estimates Source: CHR Metals Lead production in million metric tons/year Lead still dominates global battery production and is continuing to grow 4 NASDAQ: AQMS • Lead acid battery production is continuing to expand - JCI has recently announced a $450mm investment in US capacity • Lead is 100% recycled – but the dominant recycling technology (smelting) is inefficient, expensive to make environmentally compliant and produces a product which must be further refined • Given that lead is already ~100% recycled, there is an opportunity for AquaMetals to become a leader in sustainable battery technology and an innovator in the circular economy • There is a $22 billion opportunity waiting for a better lead recycling technology

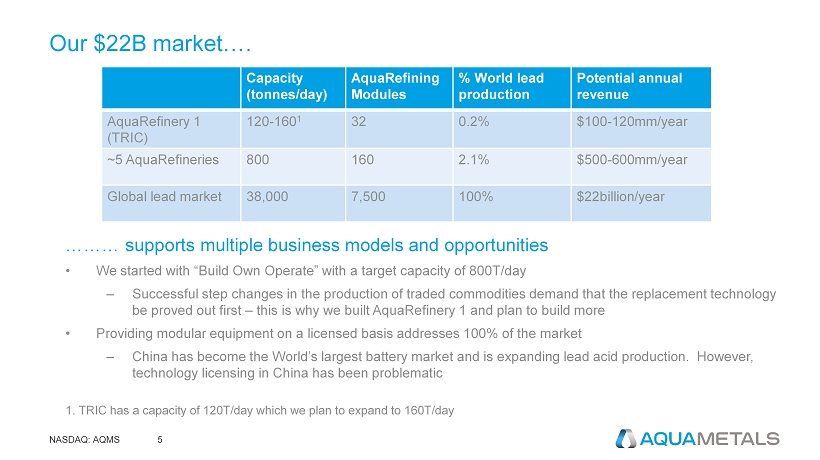

……… supports multiple business models and opportunities • We started with “Build Own Operate” with a target capacity of 800T/day – Successful step changes in the production of traded commodities demand that the replacement technology be proved out first – this is why we built AquaRefinery 1 and plan to build more • Providing modular equipment on a licensed basis addresses 100% of the market – China has become the World’s largest battery market and is expanding lead acid production. However, technology licensing in China has been problematic Our $22B market…. Capacity (tonnes/day) AquaRefining Modules % World lead production Potential annual revenue AquaRefinery 1 (TRIC) 120 - 160 1 32 0.2% $100 - 120mm/year ~5 AquaRefineries 800 160 2.1% $500 - 600mm/year Global lead market 38,000 7,500 100% $22billion/year 5 NASDAQ: AQMS 1. TRIC has a capacity of 120T/day which we plan to expand to 160T/day

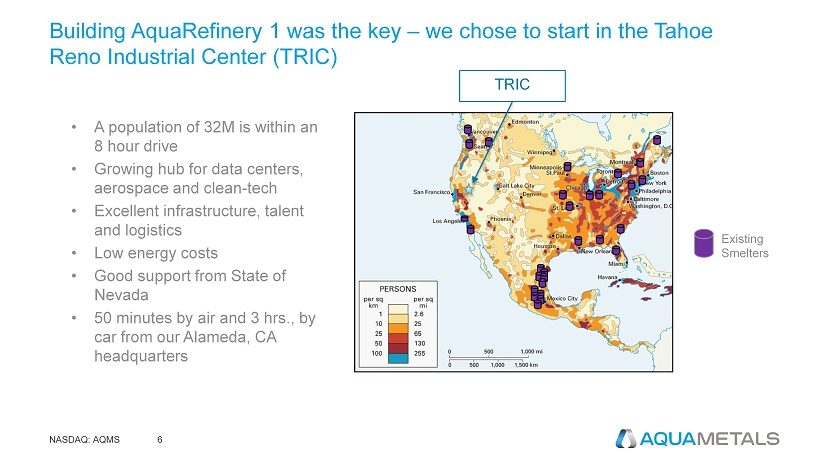

Building AquaRefinery 1 was the key – we chose to start in the Tahoe Reno Industrial Center (TRIC) • A population of 32M is within an 8 hour drive • Growing hub for data centers, aerospace and clean - tech • Excellent infrastructure, talent and logistics • Low energy costs • Good support from State of Nevada • 50 minutes by air and 3 hrs., by car from our Alameda, CA headquarters Existing Smelters TRIC 6 NASDAQ: AQMS

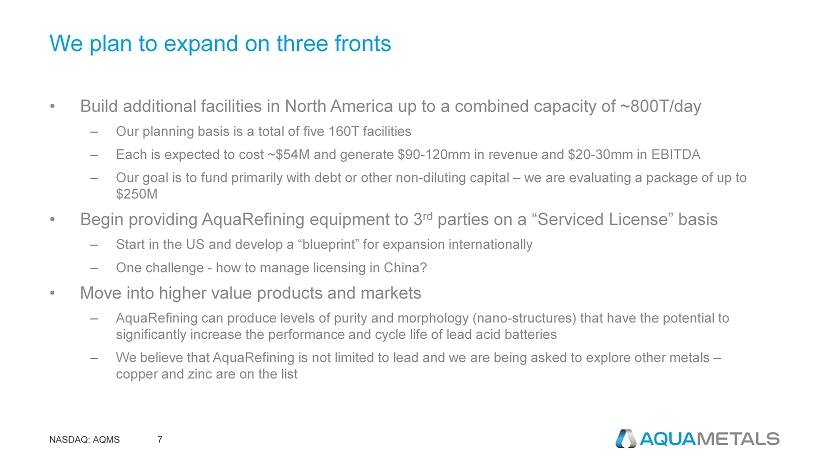

• Build additional facilities in North America up to a combined capacity of ~800T/day – Our planning basis is a total of five 160T facilities – Each is expected to cost ~$54M and generate $90 - 120mm in revenue and $20 - 30mm in EBITDA – Our goal is to fund primarily with debt or other non - diluting capital – we are evaluating a package of up to $250M • Begin providing AquaRefining equipment to 3 rd parties on a “Serviced License” basis – Start in the US and develop a “blueprint” for expansion internationally – One challenge - how to manage licensing in China? • Move into higher value products and markets – AquaRefining can produce levels of purity and morphology (nano - structures) that have the potential to significantly increase the performance and cycle life of lead acid batteries – We believe that AquaRefining is not limited to lead and we are being asked to explore other metals – copper and zinc are on the list We plan to expand on three fronts 7 NASDAQ: AQMS

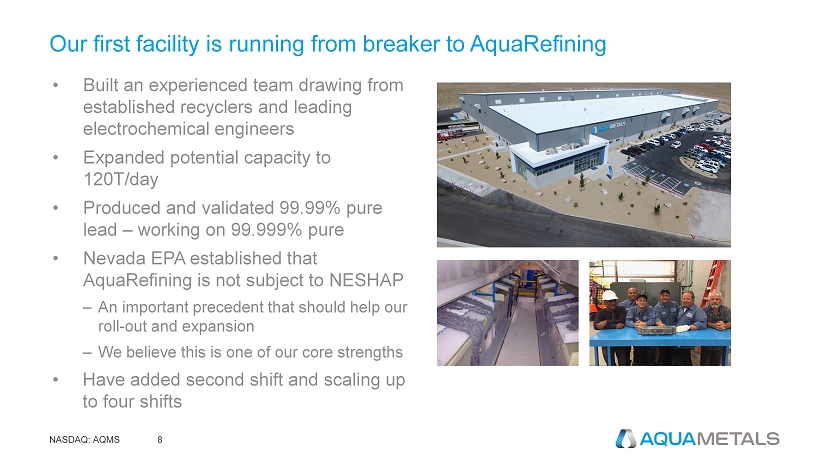

Our first facility is running from breaker to AquaRefining • Built an experienced team drawing from established recyclers and leading electrochemical engineers • Expanded potential capacity to 120T/day • Produced and validated 99.99% pure lead – working on 99.999% pure • Nevada EPA established that AquaRefining is not subject to NESHAP – An important precedent that should help our roll - out and expansion – We believe this is one of our core strengths • Have added second shift and scaling up to four shifts NASDAQ: AQMS 8

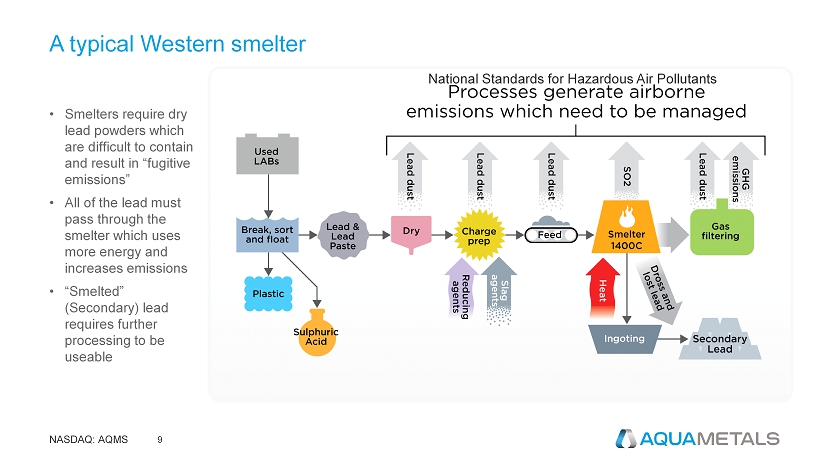

A typical Western smelter • Smelters require dry lead powders which are difficult to contain and result in “fugitive emissions” • All of the lead must pass through the smelter which uses more energy and increases emissions • “Smelted” (Secondary) lead requires further processing to be useable NASDAQ: AQMS 9 National Standards for Hazardous Air Pollutants

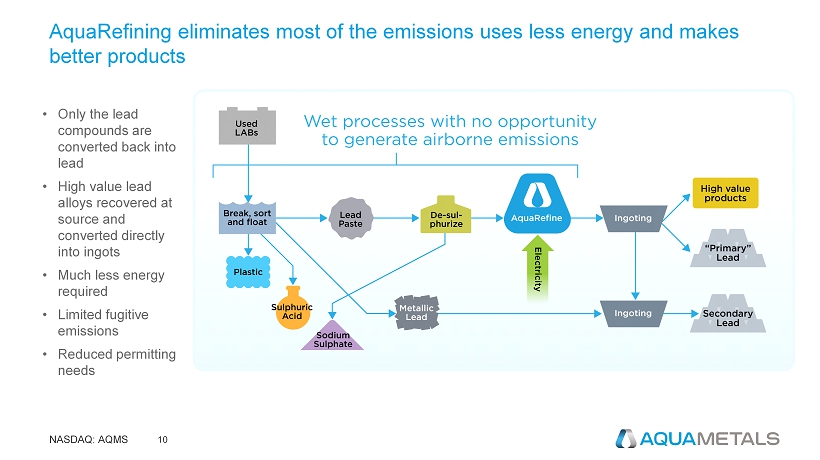

AquaRefining eliminates most of the emissions uses less energy and makes better products NASDAQ: AQMS 10 • Only the lead compounds are converted back into lead • High value lead alloys recovered at source and converted directly into ingots • Much less energy required • Limited fugitive emissions • Reduced permitting needs

AquaRefinery 1 was the first of kind, “surprises” encountered and overcome NASDAQ: AQMS 11 Conveyor jams Sorting calibration Seal and bearing changes Pump changes Unique process Multiple design improvements to support licensing

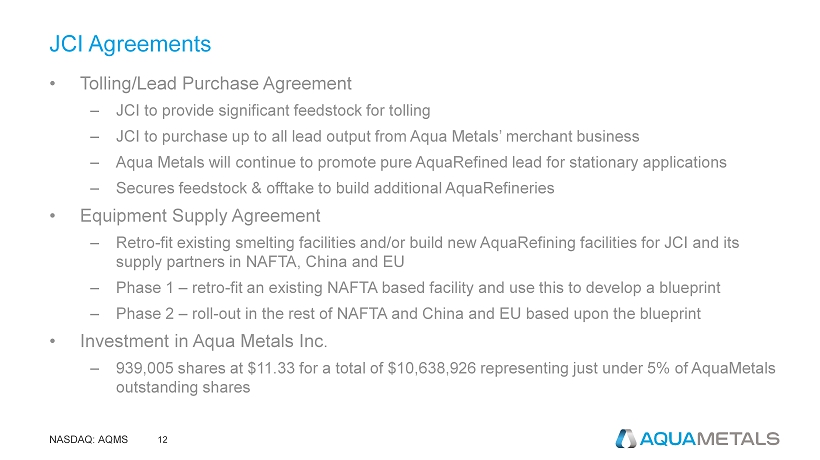

JCI Agreements • Tolling/Lead Purchase Agreement – JCI to provide significant feedstock for tolling – JCI to purchase up to all lead output from Aqua Metals’ merchant business – Aqua Metals will continue to promote pure AquaRefined lead for stationary applications – Secures feedstock & offtake to build additional AquaRefineries • Equipment Supply Agreement – Retro - fit existing smelting facilities and/or build new AquaRefining facilities for JCI and its supply partners in NAFTA, China and EU – Phase 1 – retro - fit an existing NAFTA based facility and use this to develop a blueprint – Phase 2 – roll - out in the rest of NAFTA and China and EU based upon the blueprint • Investment in Aqua Metals Inc. – 939,005 shares at $11.33 for a total of $10,638,926 representing just under 5% of AquaMetals outstanding shares NASDAQ: AQMS 12

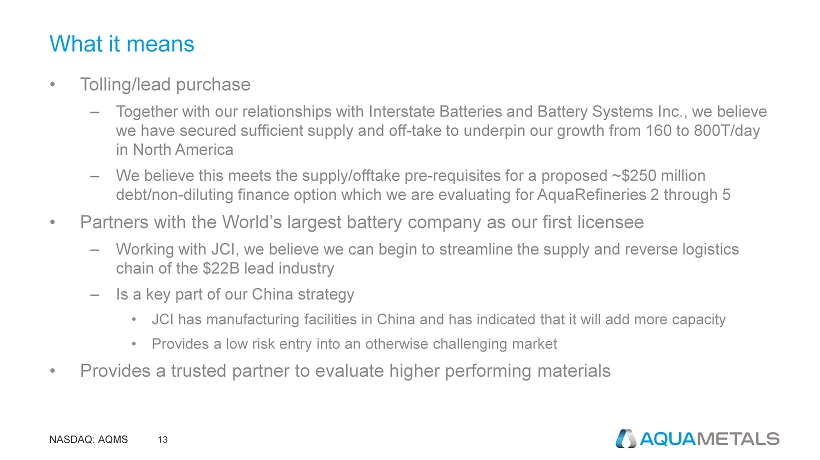

What it means • Tolling/lead purchase – Together with our relationships with Interstate Batteries and Battery Systems Inc., we believe we have secured sufficient supply and off - take to underpin our growth from 160 to 800T/day in North America – We believe this meets the supply/offtake pre - requisites for a proposed ~$250 million debt/non - diluting finance option which we are evaluating for AquaRefineries 2 through 5 • Partners with the World’s largest battery company as our first licensee – Working with JCI, we believe we can begin to streamline the supply and reverse logistics chain of the $22B lead industry – Is a key part of our China strategy • JCI has manufacturing facilities in China and has indicated that it will add more capacity • Provides a low risk entry into an otherwise challenging market • Provides a trusted partner to evaluate higher performing materials NASDAQ: AQMS 13

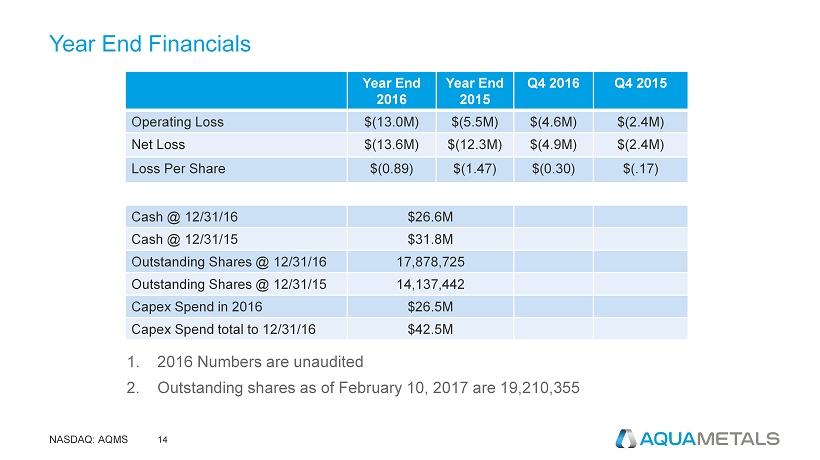

Year End Financials 1. 2016 Numbers are unaudited 2. Outstanding shares as of February 10, 2017 are 19,210,355 NASDAQ: AQMS 14 Year End 2016 Year End 2015 Q4 2016 Q4 2015 Operating Loss $(13.0M) $(5.5M) $(4.6M) $(2.4M) Net Loss $(13.6M) $(12.3M) $(4.9M) $(2.4M) Loss Per Share $(0.89) $(1.47) $(0.30) $(.17) Cash @ 12/31/16 $26.6M Cash @ 12/31/15 $31.8M Outstanding Shares @ 12/31/16 17,878,725 Outstanding Shares @ 12/31/15 14,137,442 Capex Spend in 2016 $26.5M Capex Spend total to 12/31/16 $42.5M

Summary – Executing and on - mission • Built an outstanding and committed team • Built, permitted and commissioned AquaRefinery 1 – Now ramping up production and evaluating locations for AquaRefinery 2 & 3 • Strategic partnership with Johnson Controls, the world’s largest manufacturer of automotive batteries. – Meets supply pre - requisites for AquaRefineries 2 – 5 – Launches equipment licensing in North America, China and Europe • Beginning early stage work on higher value products – Strong market pull and strong market partners • Continuing to build Strategic Relationships NASDAQ: AQMS 15

INVESTOR RELATIONS CONTACT: Greg Falesnik Senior Vice President 1 - 949 - 385 - 6449 Greg.Falesnik@mzgroup.us www.AquaMetals.com NASDAQ: AQMS