Corporate Presentation March 11, 2020 Leading a Revolution In the Lead Acid Battery Industry

Safe Harbor This document contains forward-looking statements concerning Aqua Metals, Inc. (“Aqua Metals”, the “Company,” “we,” “us,” and “our”). Forward-looking statements include, but are not limited to, our plans, objectives, expectations and intentions and other statements that contain words such as "expects," "contemplates," "anticipates," "plans," "intends," "believes", "estimates”, "potential“ and variations of such words or similar expressions that that convey uncertainty of future events or outcomes, or that do not relate to historical matters. The forward looking statements in this Corporate Presentation include our expectations for the success of our accelerated licensing strategy; our expectations for the nature and amount of licensing fees payable by our potential licensees; our expectations for the receipt of insurance proceeds from our claims relating to the November 2019 fire at our TRIC facility; the adequacy of such insurance proceeds, plus proceeds from the sale of legacy assets, to fund our licensing strategy; our ability to fund our future growth through non-dilutive forms of financing; the strength and efficacy of Aqua Metals' portfolio of patent applications and issued patents; and the future of lead acid battery recycling via traditional smelters. Those forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially. Among those factors are: (1) the risk that we may not be able to satisfactorily demonstrate to potential licensees the technical and commercial viability of our AquaRefining process; (2) the risk that licensees may refuse or be slow to adopt our AquaRefining process as an alternative to smelting in spite of the perceived benefits of AquaRefining; (3) the risk that we may not realize the expected economic benefits from any licenses we may enter into; (4) the risk that we may not receive payments from our insurance carriers in amounts sufficient to compensate us for our losses; (5) the risk that our insurance recovery and proceeds from the sale of legacy assets will not be sufficient to fund our accelerated licensing strategy; (6) the risk that we will have to engage in additional sales of our equity securities in order to fund our future operations, (7) the risk that further funding, by any means, may not be available at all; (8) the risk that our common stock may be delisted from the Nasdaq Capital Market due to our inability to regain compliance with Nasdaq’s minimum bid price requirement; (9) the fact that we only recently commenced production of AquaRefined lead and have not generated any significant revenue from the sale of AquaRefined lead to date, thus subjecting us to all of the risks inherent in an early-stage company; (10) the risk that our patents and any other patents that may be issued to it may be challenged, invalidated, or circumvented, (11) the risk that we may not realize the expected benefits of our relationship with Veolia; (12) the risk that we may not be able to successfully conclude ours proposed joint development agreement with Clarios or, if we do, realize the expected benefits of such agreement, (13) changes in the federal, state and foreign laws regulating the recycling of lead acid batteries; (14) our ability to protect our proprietary technology, trade secrets and know-how and (15) those other risks disclosed in the section "Risk Factors" included in our Annual Report on Form 10-K filed on March 11, 2020 and subsequent SEC filings. Aqua Metals cautions readers not to place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur, except as required by law. Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 2

Aqua Metals at a Glance Developed a proprietary and environmentally friendly lead acid battery recycling technology, called AquaRefining AquaRefining uses water and organic acids rather than heat and furnaces to create 99.996% ultra pure lead for the ~$20B lead recycling industry which feeds the ~$65B lead battery industry Reduced environmental impact vs. traditional smelting process Ticker: AQMS (NASDAQ) Employees: ~23 Institutional Ownership: ~44% Corporate HQ: McCarran, NV Shares Outstanding: ~58.0M Cash on Hand: ~$7.6M last Q Incorporated: 2014 Insider/Strategic Ownership: ~19% Debt: ~$8.7M Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 3

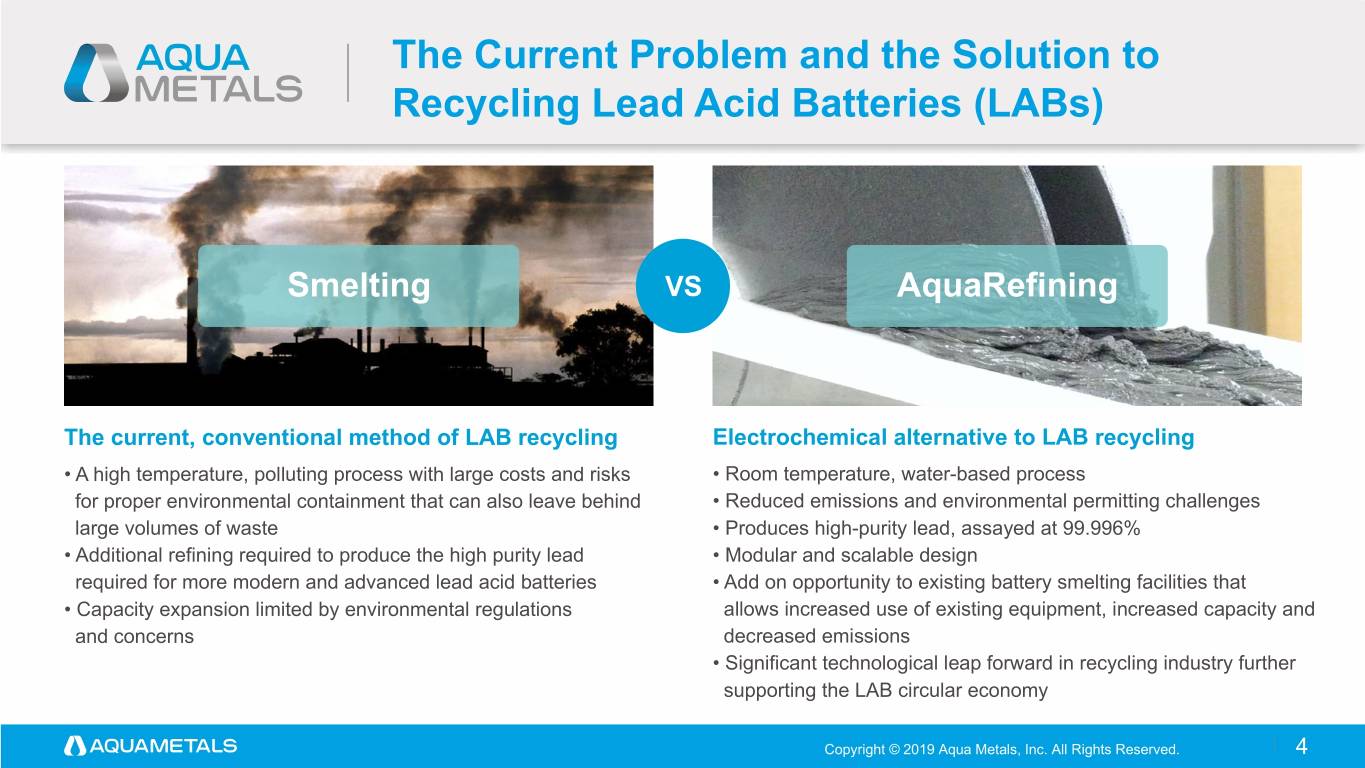

The Current Problem and the Solution to Recycling Lead Acid Batteries (LABs) Smelting AquaRefining The current, conventional method of LAB recycling Electrochemical alternative to LAB recycling • A high temperature, polluting process with large costs and risks • Room temperature, water-based process for proper environmental containment that can also leave behind • Reduced emissions and environmental permitting challenges large volumes of waste • Produces high-purity lead, assayed at 99.996% • Additional refining required to produce the high purity lead • Modular and scalable design required for more modern and advanced lead acid batteries • Add on opportunity to existing battery smelting facilities that • Capacity expansion limited by environmental regulations allows increased use of existing equipment, increased capacity and and concerns decreased emissions • Significant technological leap forward in recycling industry further supporting the LAB circular economy Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 4

Key Business Drivers $20+ billion addressable global lead recycling industry needs a major upgrade Growth in lead acid battery applications (automotive, data centers, renewables, etc.) driving market demand Industry and planet needs an environmentally friendly technology to increase sustainability by reducing emissions Technology process demonstrated at commercial quantities – leading strategic investors and partners have included industry giants – Clarios¹, Veolia, Interstate Batteries Very strong intellectual property – Creating the Purest Lead on Earth Over $180M invested towards commercialization - 86 patent applications filed/pending and 27 patents granted in the US and internationally Go forward business model 1) Core technologies, process and commerciality of AquaRefined lead is already proven 2) Business model focus is on global licensing opportunity to incorporate AquaRefining in industry upgrades/builds ¹ Johnson Controls International’s power solutions business sold to Brookfield Business Partners on 11/13/18 for $13.2bn. The power solutions business rebranded as Clarios on 05/01/19. Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 5

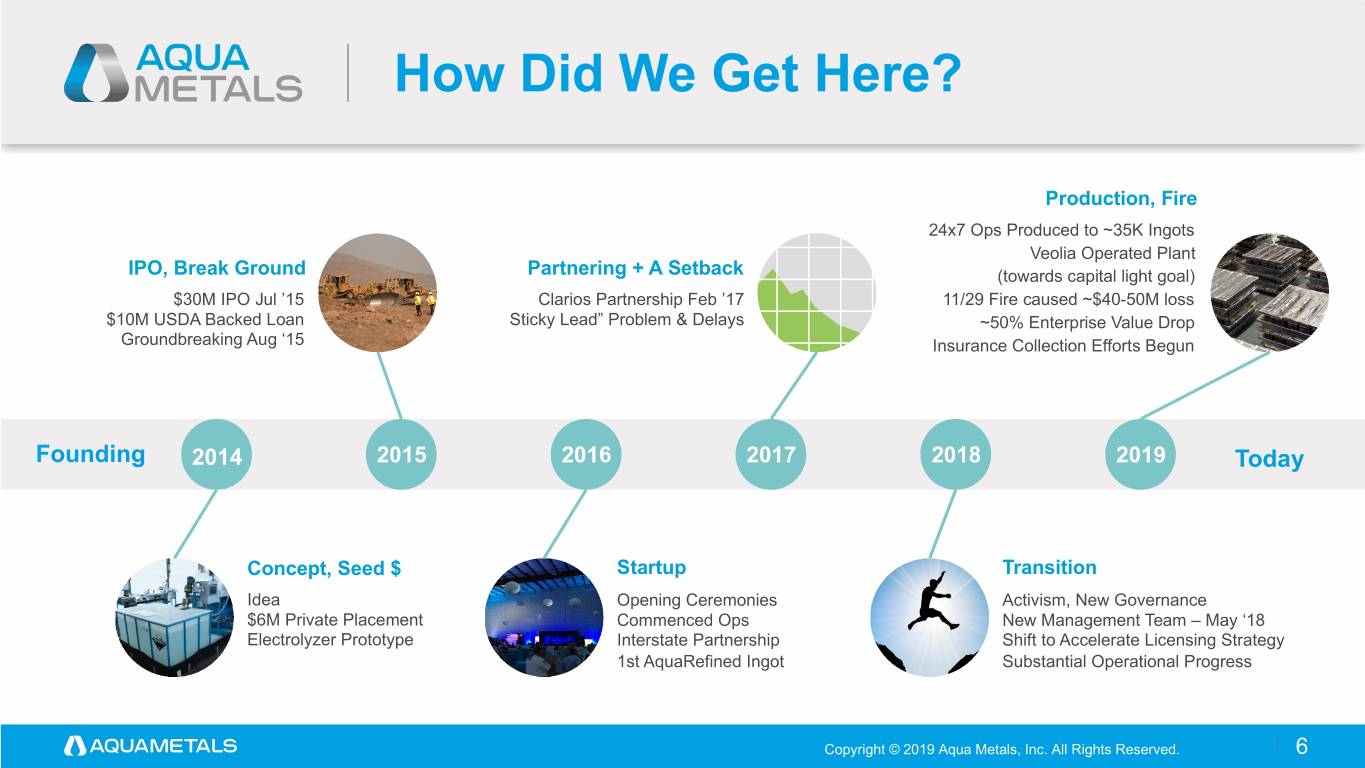

How Did We Get Here? Production, Fire 24x7 Ops Produced to ~35K Ingots Veolia Operated Plant IPO, Break Ground Partnering + A Setback (towards capital light goal) $30M IPO Jul ’15 Clarios Partnership Feb ’17 11/29 Fire caused ~$40-50M loss $10M USDA Backed Loan Sticky Lead” Problem & Delays ~50% Enterprise Value Drop Groundbreaking Aug ‘15 Insurance Collection Efforts Begun Founding 2014 Today Concept, Seed $ Startup Transition Idea Opening Ceremonies Activism, New Governance $6M Private Placement Commenced Ops New Management Team – May ‘18 Electrolyzer Prototype Interstate Partnership Shift to Accelerate Licensing Strategy 1st AquaRefined Ingot Substantial Operational Progress Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 6

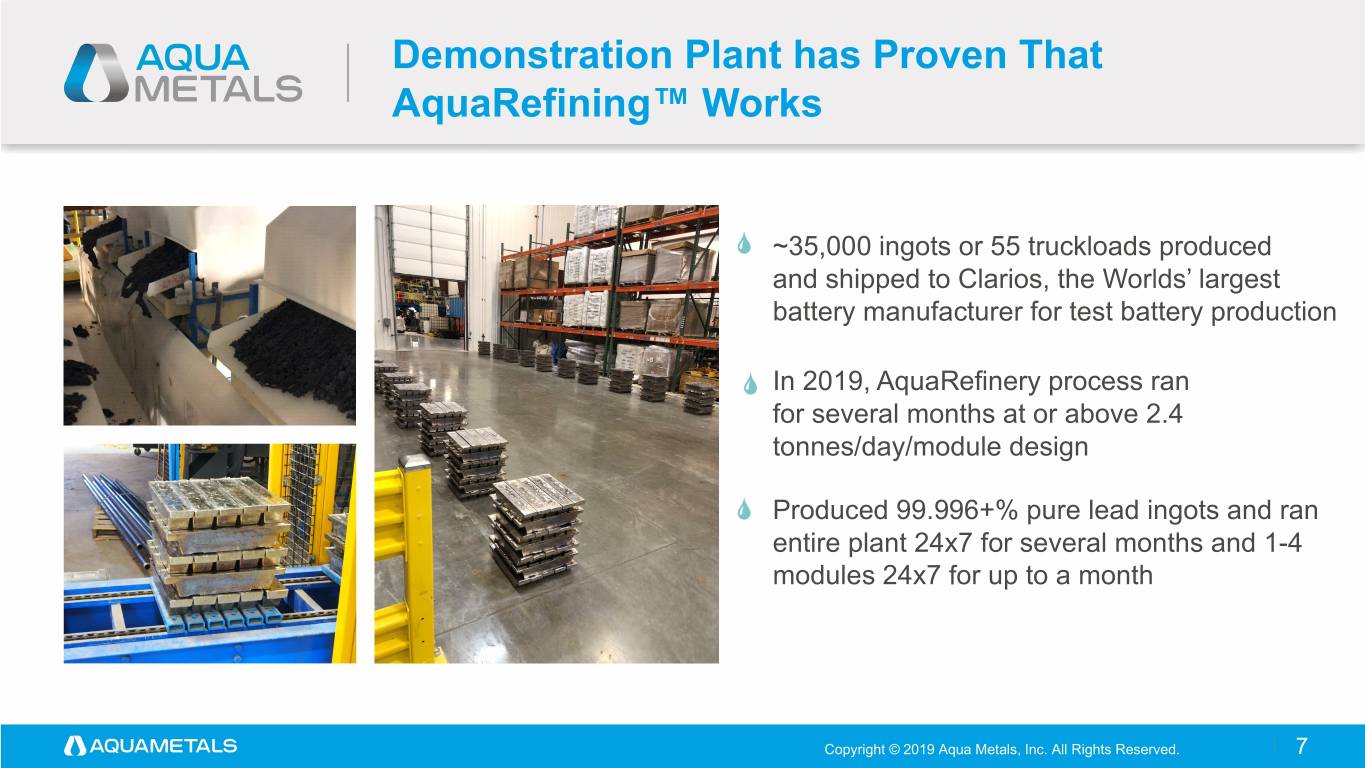

Demonstration Plant has Proven That AquaRefining™ Works ~35,000 ingots or 55 truckloads produced and shipped to Clarios, the Worlds’ largest battery manufacturer for test battery production In 2019, AquaRefinery process ran for several months at or above 2.4 tonnes/day/module design Produced 99.996+% pure lead ingots and ran entire plant 24x7 for several months and 1-4 modules 24x7 for up to a month Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 7

Fire Event – November 29, 2019 Cause of fire was not related to Aqua technology or process but rather contracting work being done in the AquaRefining area Occurred during final weeks of preparation to scale from 4 to full capacity of 16 AquaRefining modules Insurance - $37M+ claims so far in equipment damages + $15M+ claims in business interruption With insurance collection cadence and timing uncertain, Company initiated a massive reduction in cash burn early December 2019 Late Q4 and Q1 focus was on assessment, investigation and early insurance collection efforts (now at $10M) along with formulating our go forward plan Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 8

We Have Shifted To Accelerate To Licensing & Our Capital Light Strategy Build Cash - Conserving and building our cash balance and runway Finalize Licensed Electrolyzer - Run 1-2 updated electrolyzers in Q2 in final licensable form License AquaRefining - Identify Licensing site #1 in 2020 for deployment in 2021 Emerge Debt Free - We expect to retire ~$8.6M debt in 2020 This business strategy is intended to build balance sheet cash through insurance collection + asset disposition as appropriate and accelerate our prior global licensing efforts to equip existing or planned battery recycling facilities with AquaRefining beginning in 2021 Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 9

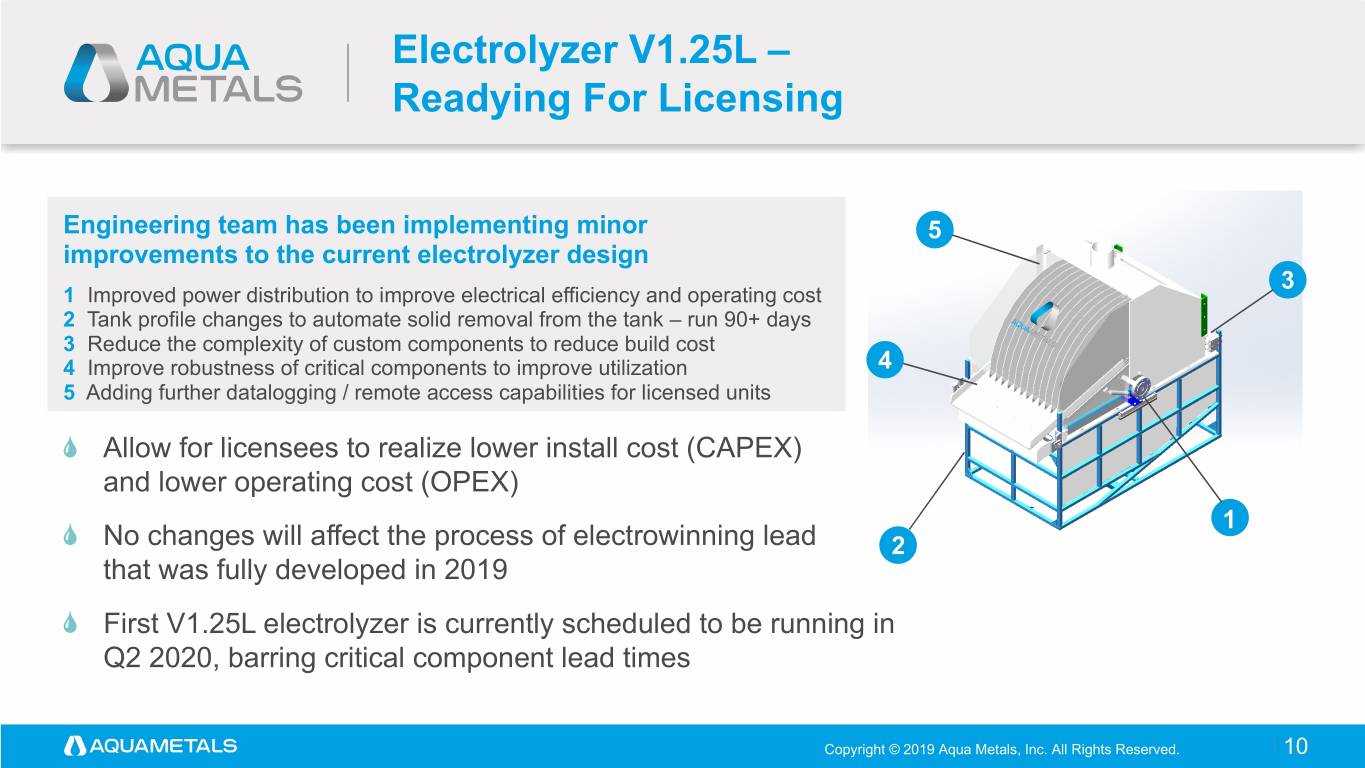

Electrolyzer V1.25L – Readying For Licensing Engineering team has been implementing minor improvements to the current electrolyzer design 1 Improved power distribution to improve electrical efficiency and operating cost 2 Tank profile changes to automate solid removal from the tank – run 90+ days 3 Reduce the complexity of custom components to reduce build cost 4 Improve robustness of critical components to improve utilization 5 Adding further datalogging / remote access capabilities for licensed units Allow for licensees to realize lower install cost (CAPEX) and lower operating cost (OPEX) 1 No changes will affect the process of electrowinning lead that was fully developed in 2019 First V1.25L electrolyzer is currently scheduled to be running in Q2 2020, barring critical component lead times Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 10

2020 First Half Initiatives Collect Insurance Proceeds - Working with public adjustor + specialized counsel to assist in facilitating payment collections for casualty + business interruption losses Sell Unneeded Assets - Balance sheet shows ~$37M (NBV) on books for equipment, some can be sold and redeployed to licensed site(s) Restructure Debt for 2020 Retirement – ~$8.6M remaining balance on the USDA backed loan with Veritex (Green Bank) to be retired Build and Run V1.25L electrolyzers – Designed improvements intended to reduce build cost and operating cost for better value proposition to licensees while increasing utilization rate for more throughput. Plan to run 1-2 new units beginning in Q2 Seek to Contract Licensed Site #1 – Several interested parties currently exist in addition to Clarios. Work to pick the best fit for site #1 by Q4/2020 or Q1/2021 and plan to deploy 1st site in 2021 R&D Focus on Licensing – Build out support tools for new customers Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 11

Our Cash Needs Runway Can Be Non-dilutive 2020~2021 2022 & Beyond Fund Capital Light Pivot From Insurance Proceeds Potential Licensing Revenue + Asset Sales Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 12

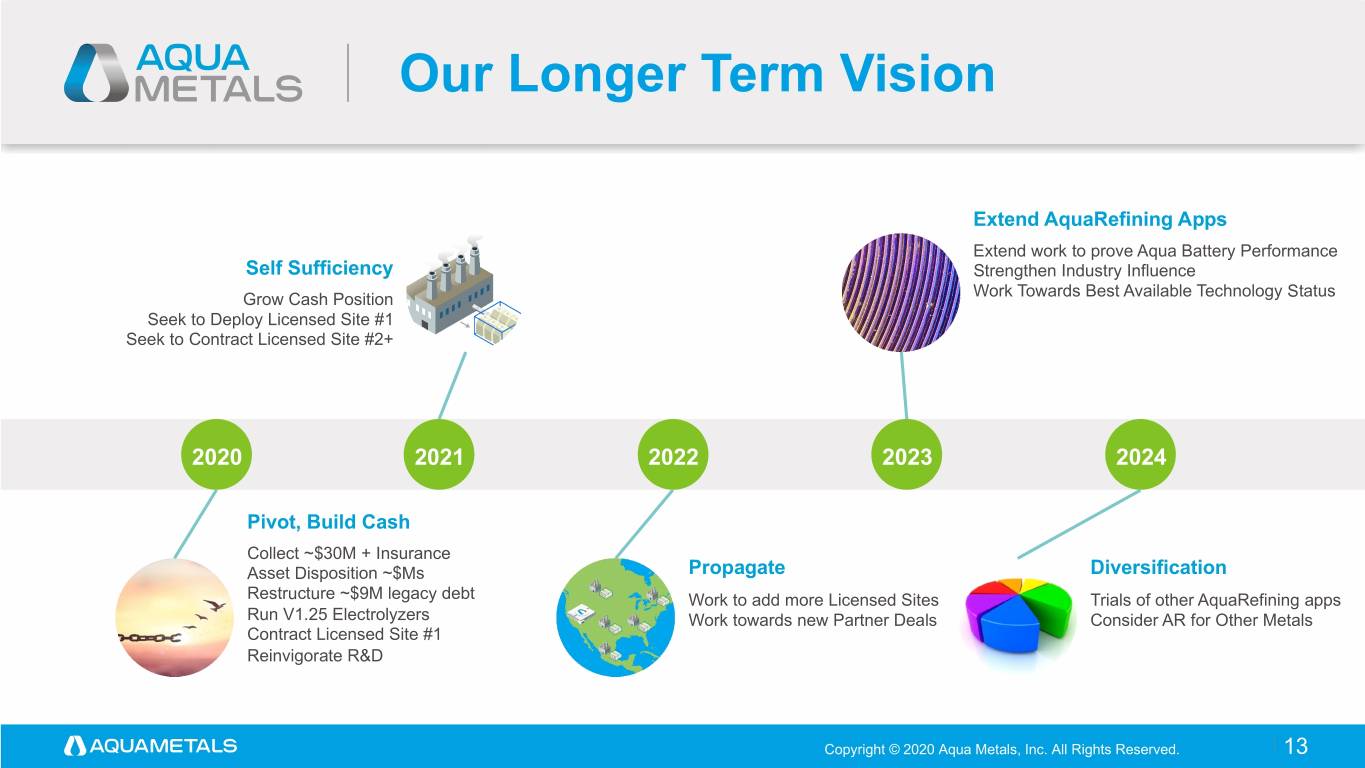

Our Longer Term Vision Extend AquaRefining Apps Extend work to prove Aqua Battery Performance Self Sufficiency Strengthen Industry Influence Grow Cash Position Work Towards Best Available Technology Status Seek to Deploy Licensed Site #1 Seek to Contract Licensed Site #2+ 2020 2021 2022 2023 2024 Pivot, Build Cash Collect ~$30M + Insurance Asset Disposition ~$Ms Propagate Diversification Restructure ~$9M legacy debt Work to add more Licensed Sites Trials of other AquaRefining apps Run V1.25 Electrolyzers Work towards new Partner Deals Consider AR for Other Metals Contract Licensed Site #1 Reinvigorate R&D Copyright © 2020 Aqua Metals, Inc. All Rights Reserved. 13

Market Drivers New High-Growth LAB Applications Require High-Purity Lead Auto growth in emerging Renewable energy Data Center & Telecom Electric Vehicles use markets - China, India and economy is growing and industries are growing lead batteries in addition South America Cars dependent on energy rapidly and utilize to Lithium-Ion to are using additional lead storage to be efficient lead batteries for support electronics batteries for start stop and effective backup power functionality Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 14

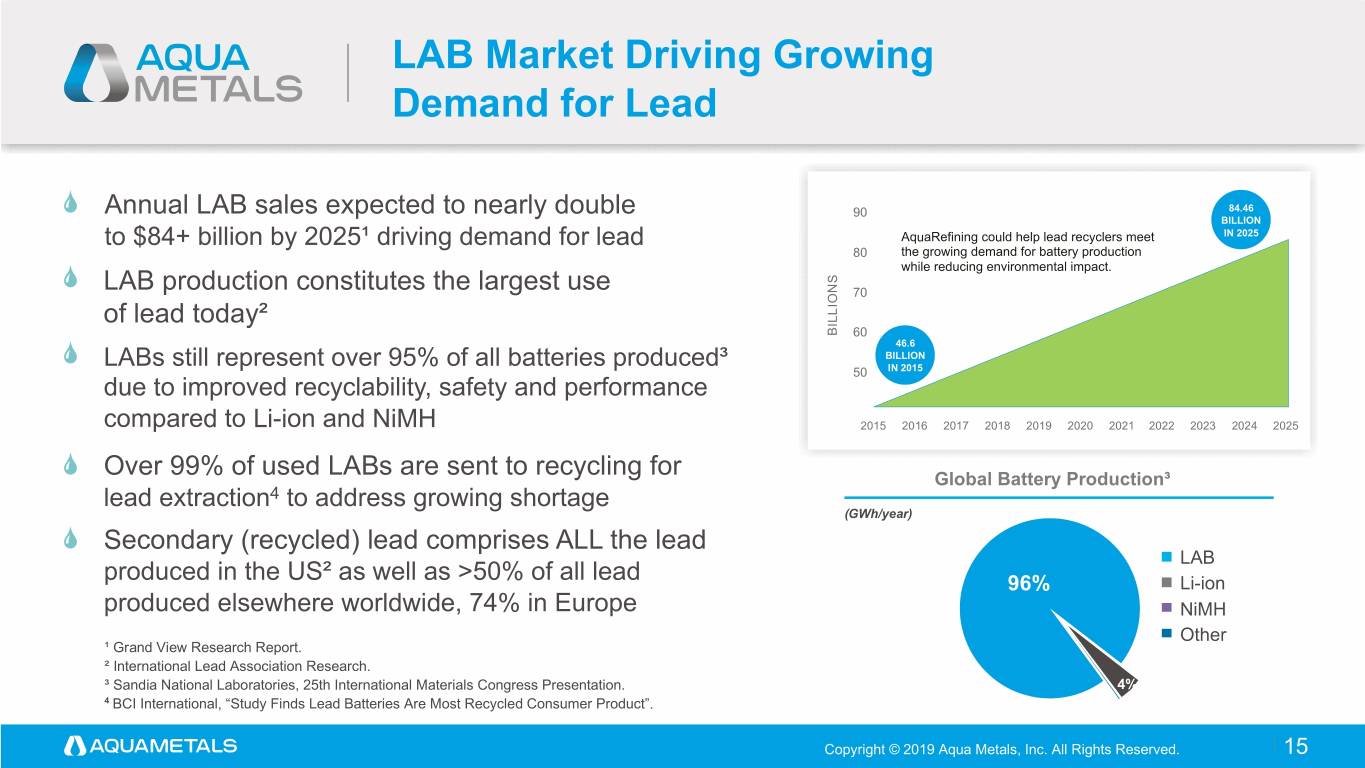

LAB Market Driving Growing Demand for Lead Annual LAB sales expected to nearly double 90 84.46 BILLION to $84+ billion by 2025¹ driving demand for lead AquaRefining could help lead recyclers meet IN 2025 80 the growing demand for battery production while reducing environmental impact. S LAB production constitutes the largest use N 70 O I L L of lead today² I B 60 46.6 LABs still represent over 95% of all batteries produced³ BILLION ESTIMATED LEAD BATTERY 50 IN 2015 MARKET GROWTH due to improved recyclability, safety and performance compared to Li-ion and NiMH 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Over 99% of used LABs are sent to recycling for Global Battery Production³ lead extraction4 to address growing shortage (GWh/year) Secondary (recycled) lead comprises ALL the lead LAB produced in the US² as well as >50% of all lead 96% Li-ion produced elsewhere worldwide, 74% in Europe NiMH Other ¹ Grand View Research Report. ² International Lead Association Research. ³ Sandia National Laboratories, 25th International Materials Congress Presentation. 4% 4 BCI International, “Study Finds Lead Batteries Are Most Recycled Consumer Product”. Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 15

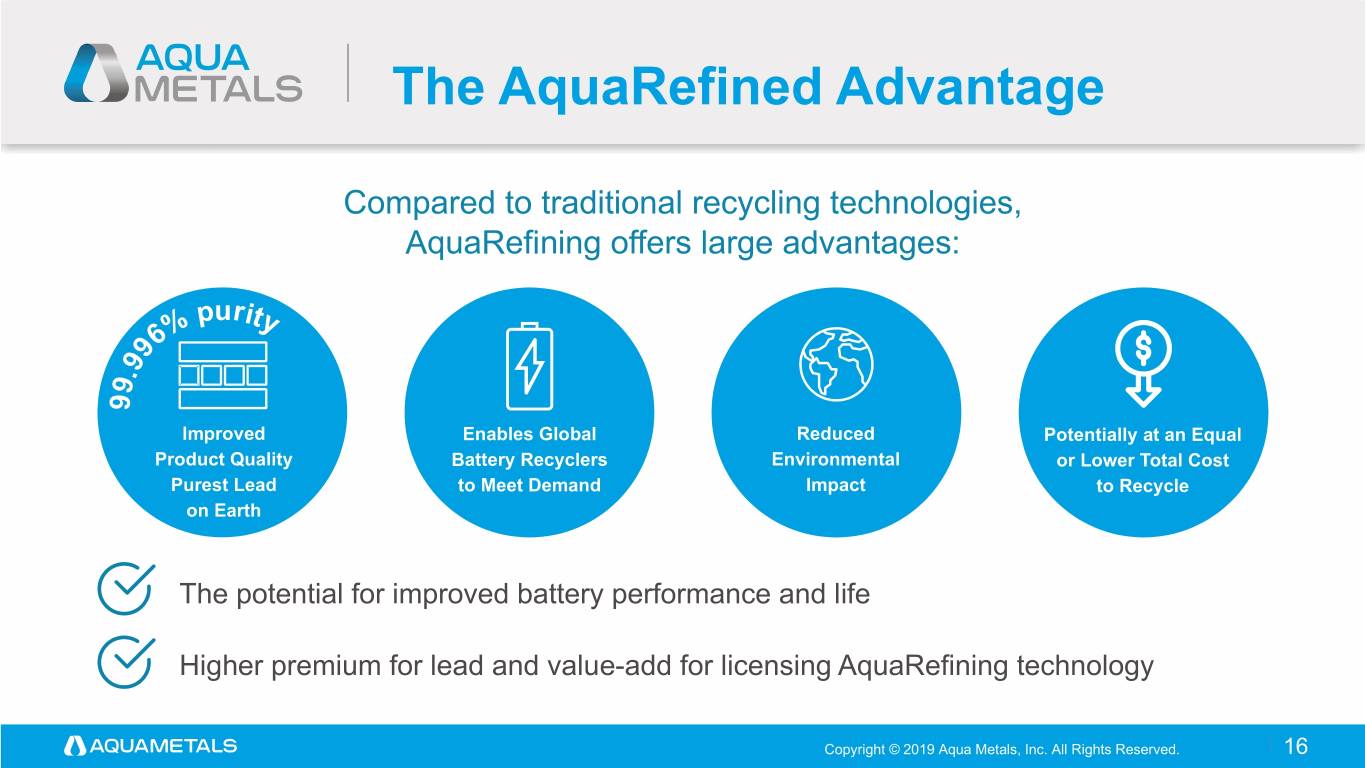

The AquaRefined Advantage Compared to traditional recycling technologies, AquaRefining offers large advantages: purity 6% 9 9 . 9 9 Improved Enables Global Reduced Potentially at an Equal Product Quality Battery Recyclers Environmental or Lower Total Cost Purest Lead to Meet Demand Impact to Recycle on Earth The potential for improved battery performance and life Higher premium for lead and value-add for licensing AquaRefining technology Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 16

Planned Revenue Sources 2020 - Insurance Collections Sets up potentially lucrative global • Already collected $10M of insurance payouts licensing model for existing and • Working towards total payout of up to $50M greenfield battery recycling facilities • Licensing model is built; licensee pipeline started 2020/21 - Sale of Unneeded Assets • Seeking engineering revenues of 6 to 7 figures per project • Could yield $10M+ in 2020/2021 • Projecting possible equipment supply revenue of • Opportunity to redeploy some equipment to 1st Licensed Site over $10m plus per project • Recurring running royalties on lead produced 2021/22+ - Equipment, Services, Royalties • Additional millions of dollars in revenues could • Sales of AquaRefining Equipment potentially be generated for maintenance and • Sales of Engineering and other Services upgrades over plant lifetime • Running Royalty • Sales of Maintenance Services Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 17

AquaRefining Licensing Opportunity Aqua Metals’ vision is to partner with battery recycling centers across the globe to increase production without increasing emissions – over 300 potential plants already identified We Believe Recycling Centers Have Two Models For Retrofitting With AquaRefining: Increase production without increasing Keep total production the same by 1 emissions by adding AquaRefining but 2 adding AquaRefining and reducing keeping furnace capacity furnace usage while reducing emissions Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 18

Licensing Market Drivers Secondary lead demand is projected to increase by an estimated 1,803,000 tonnes between 2018 and 2030¹ All new batteries need 70% - 85% recycled lead We believe Secondary lead demand will eventually surpass Secondary lead smelting capacity due to environmental limits on furnace permitting • The EU and CA are considering outlawing lead batteries/products/smelting • Environmental regulations are tightening in China • Battery manufacturers rely on unregulated smelters and smelters under pressure from regulators to meet demand currently - they understand this to be a big risk (1) Source: Wood McKenzie Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 19

Smelters Could Benefit From “AquaFit” “AquaFit” – Adding AquaRefining to Smelters • Increase capacity without the permitting challenges of adding a furnace while reducing emissions • Lower emissions without decreasing capacity • Can produce higher quality product • Produce the purest lead on Earth resulting in higher premiums • Public relations advantage and potential reputational protection with consumers Battery Manufacturers with recycling • Can meet growing demand for ultra pure lead, driven by increased sales of the newest high-performance batteries • Ability to market performance enhancement obtained by using pure lead as well as by the “Green” nature of their products Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 20

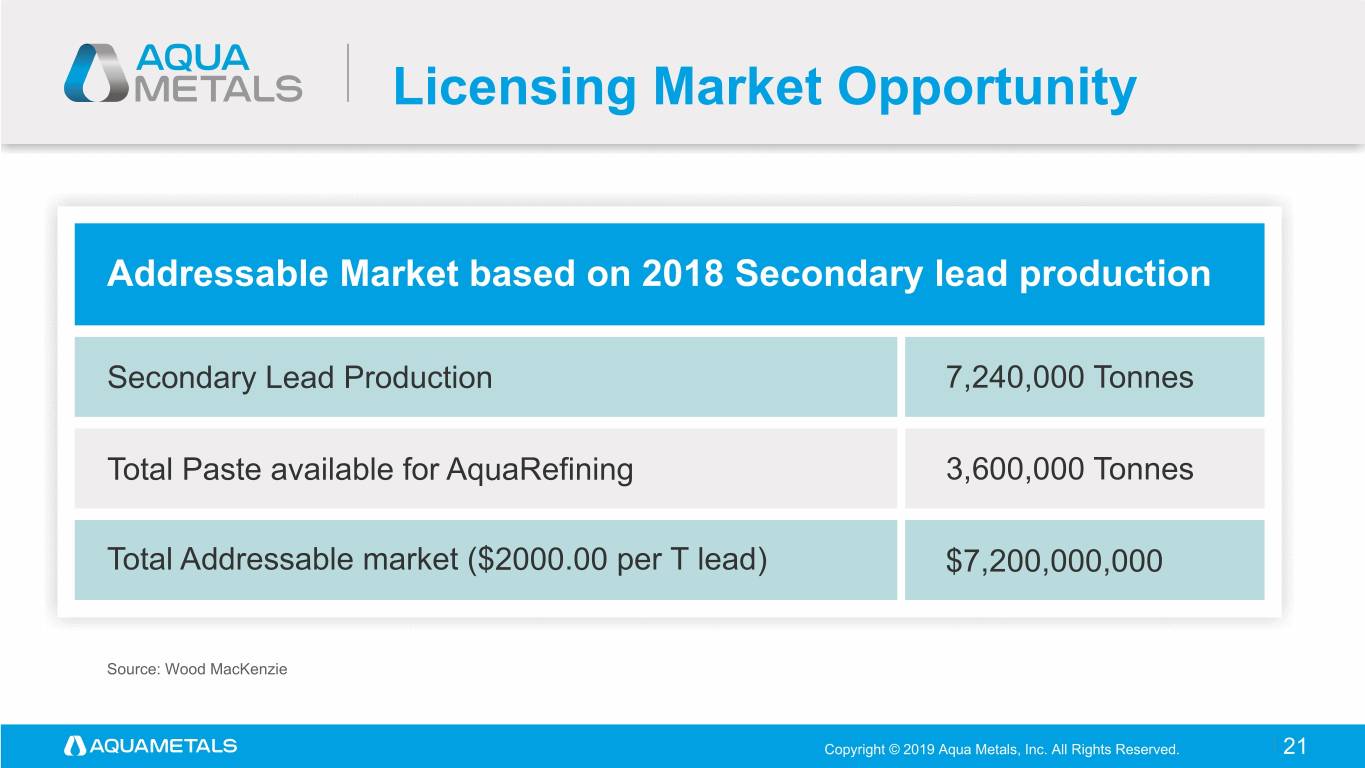

Licensing Market Opportunity Addressable Market based on 2018 Secondary lead production Secondary Lead Production 7,240,000 Tonnes Total Paste available for AquaRefining 3,600,000 Tonnes Total Addressable market ($2000.00 per T lead) $7,200,000,000 Source: Wood MacKenzie Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 21

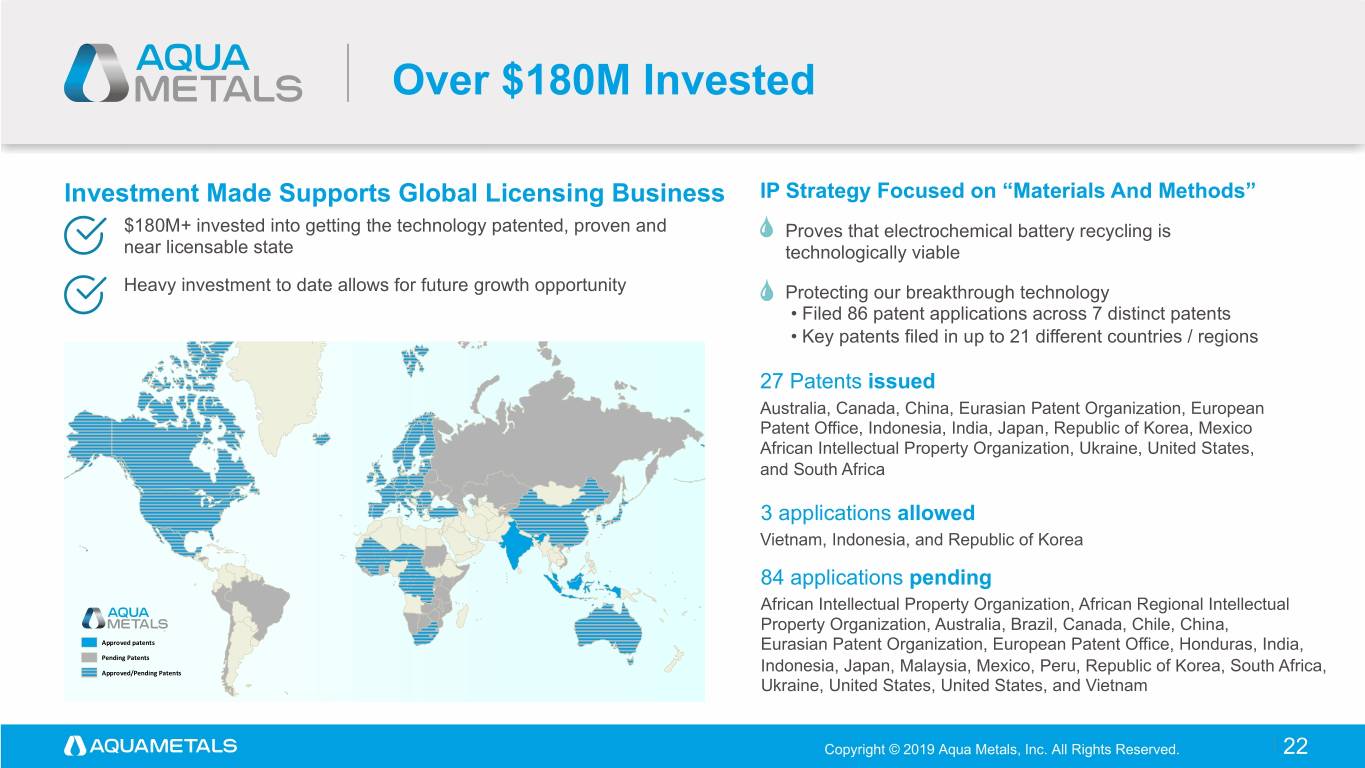

Over $180M Invested Investment Made Supports Global Licensing Business IP Strategy Focused on “Materials And Methods” $180M+ invested into getting the technology patented, proven and Proves that electrochemical battery recycling is near licensable state technologically viable Heavy investment to date allows for future growth opportunity Protecting our breakthrough technology • Filed 86 patent applications across 7 distinct patents • Key patents filed in up to 21 different countries / regions 27 Patents issued Australia, Canada, China, Eurasian Patent Organization, European Patent Office, Indonesia, India, Japan, Republic of Korea, Mexico African Intellectual Property Organization, Ukraine, United States, and South Africa 3 applications allowed Vietnam, Indonesia, and Republic of Korea 84 applications pending African Intellectual Property Organization, African Regional Intellectual Property Organization, Australia, Brazil, Canada, Chile, China, Approved patents Eurasian Patent Organization, European Patent Office, Honduras, India, Pending Patents Approved/Pending Patents Indonesia, Japan, Malaysia, Mexico, Peru, Republic of Korea, South Africa, Ukraine, United States, United States, and Vietnam Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 22

Experienced Management and Engaged Board Focused on Execution Executive Management Team Independent Directors Stephen Cotton, President and CEO, Executive Director S. Shariq Yosufzai, Non-Executive Chairman • Aqua Metals’ Chief Commercial Officer from January 2015 to June 2017 • Held various executive positions at Chevron for 20+ years and has held numerous Board and • 15 years as Co-Founder and CEO of data center battery-monitoring company, Canara; exited Chairman positions to a private equity firm in 2012 Gayle Gibson, Independent Director Judd Merrill, CFO • 30+ years of engineering and executive experience at DuPont, including leading DuPont • Former Director of Finance / Accounting for Klondex Mines Ltd., Former CFO of Comstock Engineering; an extensive background in process development and improvement Mining with proven skills in SEC compliance and reporting, budgeting, forecasting, inventory management, M&A and project management Vincent DiVito, Chair of the Audit Committee • Experienced NASDAQ audit committee chair; former CFO of fast-growing Ben Taecker, Vice President of Engineering & Operations specialty chemicals company • 18 years of experience in manufacturing and ops leadership including 6 years at Johnson Controls’ (now Clarios) Lead Acid Battery Recycling Center in Florence, SC with involvement in engineering, planning, construction, commissioning and scaling Sushil ("Sam") Kapoor, Chair of Compensation Committee • 30+ years of technology and operations experience; former Chief Global Operations Officer of Equinix, ran design / build / ops from 7-200+ sites while market cap grew from <$100M to $35B Susanne Meline, Independent Director • 20+ years of advising corporations and their boards as a lawyer, investment banker and lead director as well as working in the small cap investment community Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 23

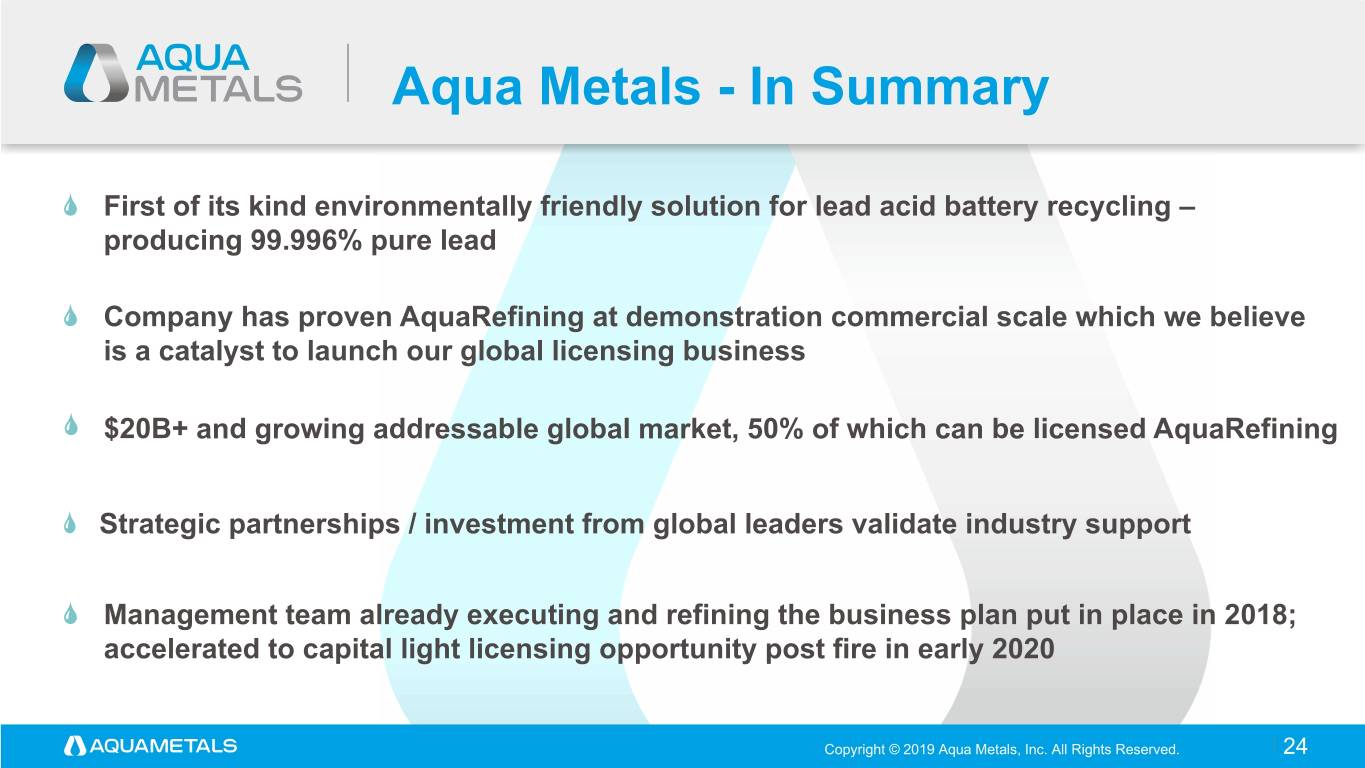

Aqua Metals - In Summary First of its kind environmentally friendly solution for lead acid battery recycling – producing 99.996% pure lead Company has proven AquaRefining at demonstration commercial scale which we believe is a catalyst to launch our global licensing business $20B+ and growing addressable global market, 50% of which can be licensed AquaRefining Strategic partnerships / investment from global leaders validate industry support Management team already executing and refining the business plan put in place in 2018; accelerated to capital light licensing opportunity post fire in early 2020 Copyright © 2019 Aqua Metals, Inc. All Rights Reserved. 24

Financial Overview 25

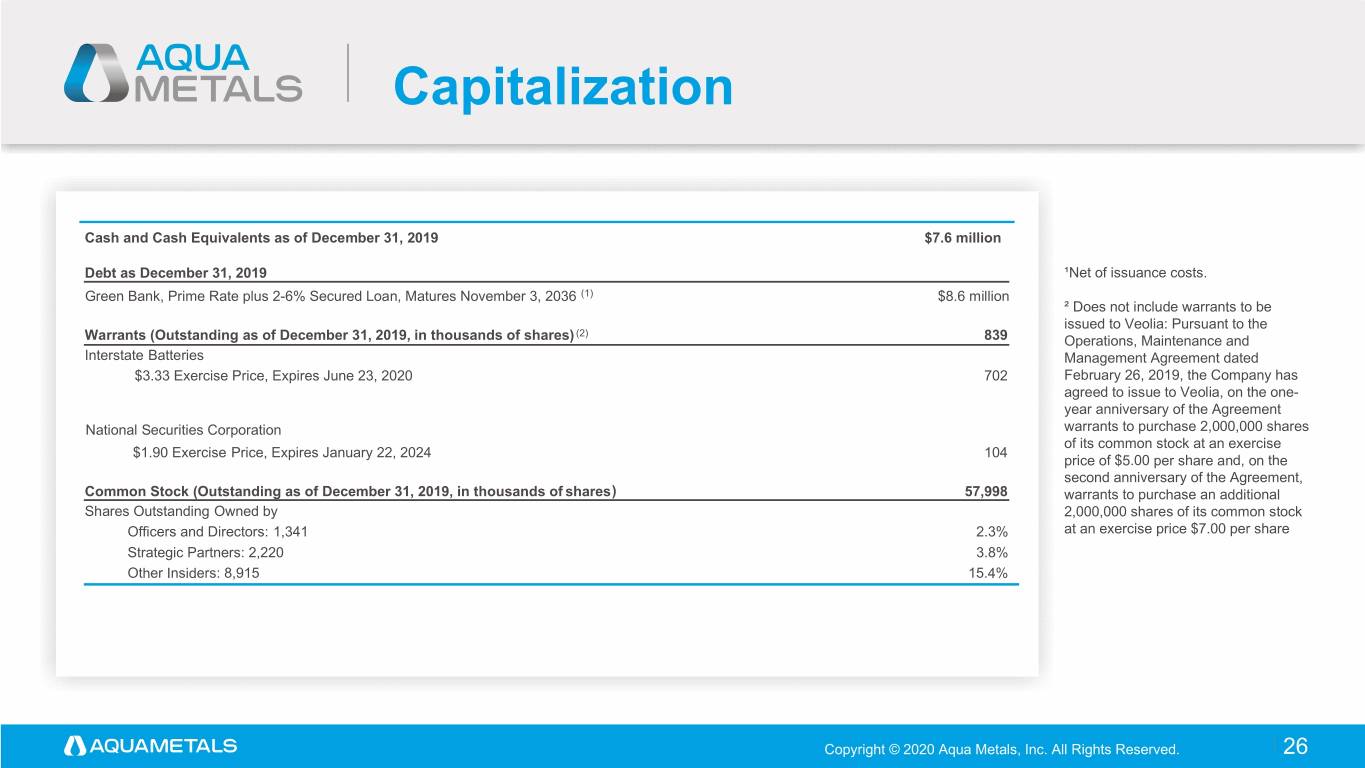

Capitalization Cash and Cash Equivalents as of December 31, 2019 $7.6 million Debt as December 31, 2019 ¹Net of issuance costs. Green Bank, Prime Rate plus 2-6% Secured Loan, Matures November 3, 2036 (1) $8.6 million ² Does not include warrants to be issued to Veolia: Pursuant to the (2) Warrants (Outstanding as of December 31, 2019, in thousands of shares) 839 Operations, Maintenance and Interstate Batteries Management Agreement dated $3.33 Exercise Price, Expires June 23, 2020 702 February 26, 2019, the Company has agreed to issue to Veolia, on the one- year anniversary of the Agreement National Securities Corporation warrants to purchase 2,000,000 shares of its common stock at an exercise $1.90 Exercise Price, Expires January 22, 2024 104 price of $5.00 per share and, on the second anniversary of the Agreement, Common Stock (Outstanding as of December 31, 2019, in thousands of shares) 57,998 warrants to purchase an additional Shares Outstanding Owned by 2,000,000 shares of its common stock Officers and Directors: 1,341 2.3% at an exercise price $7.00 per share Strategic Partners: 2,220 3.8% Other Insiders: 8,915 15.4% Copyright © 2020 Aqua Metals, Inc. All Rights Reserved. 26

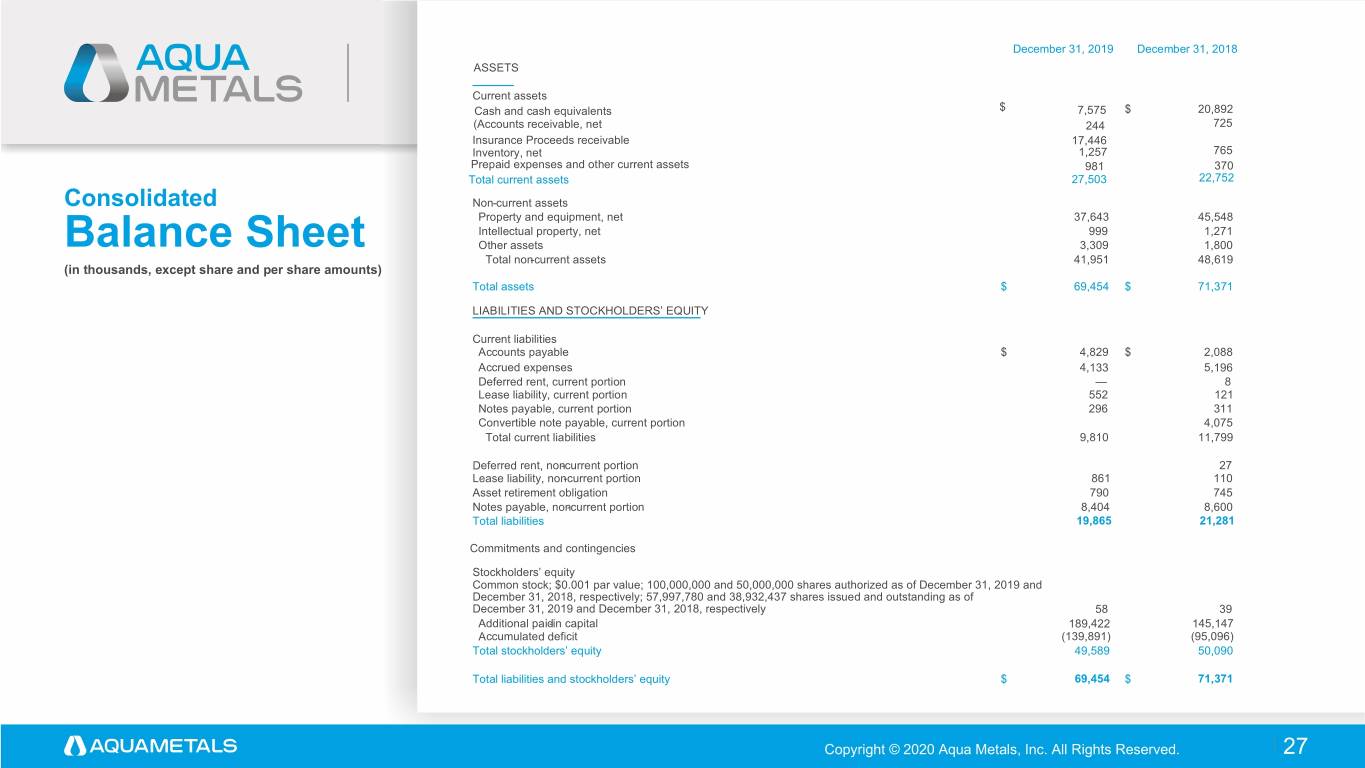

December 31, 2019 December 31, 2018 ASSETS Current assets Cash and cash equivalents $ 7,575 $ 20,892 (Accounts receivable, net 244 725 Insurance Proceeds receivable 17,446 Inventory, net 1,257 765 Prepaid expenses and other current assets 981 370 Total current assets 27,503 22,752 Consolidated Non-current assets Property and equipment, net 37,643 45,548 Intellectual property, net 999 1,271 Balance Sheet Other assets 3,309 1,800 Total non-current assets 41,951 48,619 (in thousands, except share and per share amounts) Total assets $ 69,454 $ 71,371 LIABILITIES AND STOCKHOLDERS’ EQUITY Current liabilities Accounts payable $ 4,829 $ 2,088 Accrued expenses 4,133 5,196 Deferred rent, current portion — 8 Lease liability, current portion 552 121 Notes payable, current portion 296 311 Convertible note payable, current portion 4,075 Total current liabilities 9,810 11,799 Deferred rent, non-current portion 27 Lease liability, non-current portion 861 110 Asset retirement obligation 790 745 Notes payable, non-current portion 8,404 8,600 Total liabilities 19,865 21,281 Commitments and contingencies Stockholders’ equity Common stock; $0.001 par value; 100,000,000 and 50,000,000 shares authorized as of December 31, 2019 and December 31, 2018, respectively; 57,997,780 and 38,932,437 shares issued and outstanding as of December 31, 2019 and December 31, 2018, respectively 58 39 Additional paid-in capital 189,422 145,147 Accumulated deficit (139,891) (95,096) Total stockholders’ equity 49,589 50,090 Total liabilities and stockholders’ equity $ 69,454 $ 71,371 Copyright © 2020 Aqua Metals, Inc. All Rights Reserved. 27

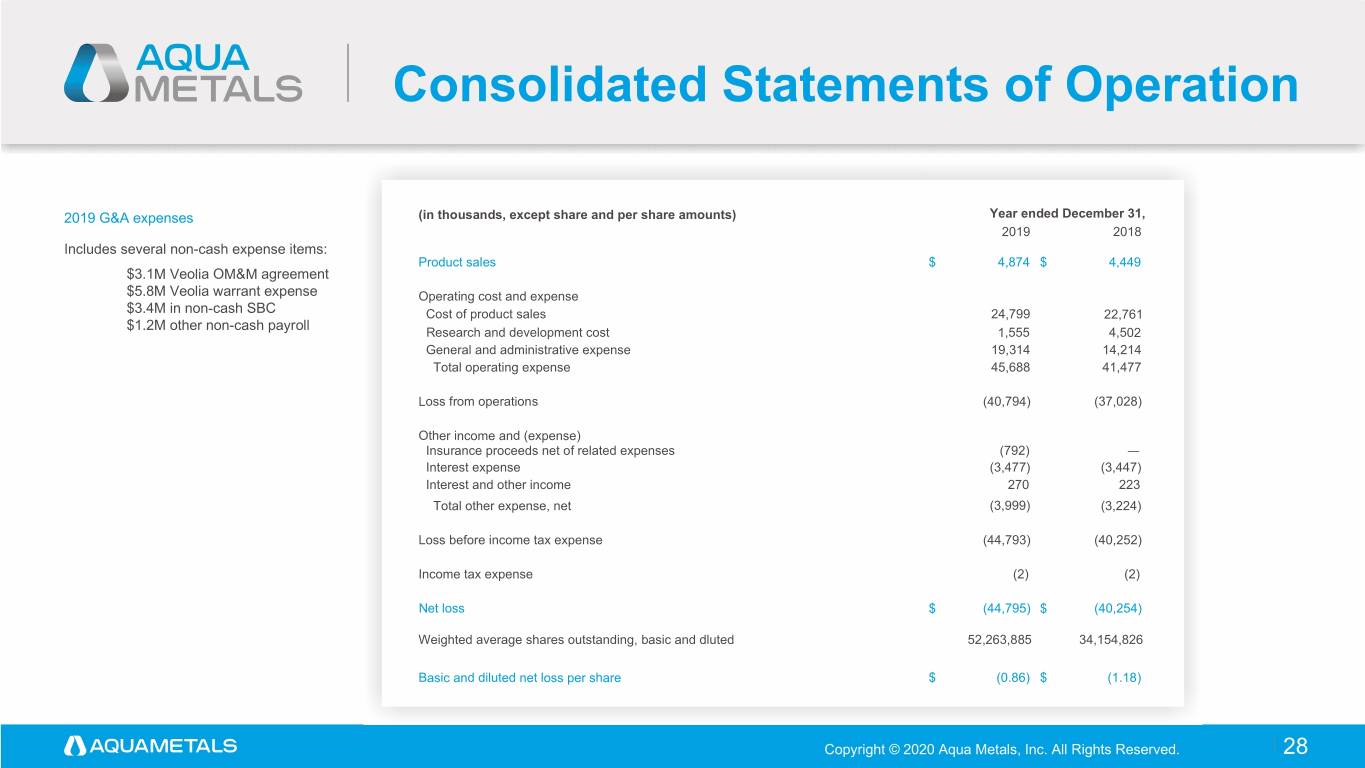

Consolidated Statements of Operation 2019 G&A expenses (in thousands, except share and per share amounts) Year ended December 31, 2019 2018 Includes several non-cash expense items: Product sales $ 4,874 $ 4,449 $3.1M Veolia OM&M agreement $5.8M Veolia warrant expense Operating cost and expense $3.4M in non-cash SBC Cost of product sales 24,799 22,761 $1.2M other non-cash payroll Research and development cost 1,555 4,502 General and administrative expense 19,314 14,214 Total operating expense 45,688 41,477 Loss from operations (40,794) (37,028) Other income and (expense) Insurance proceeds net of related expenses (792) — Interest expense (3,477) (3,447) Interest and other income 270 223 Total other expense, net (3,999) (3,224) Loss before income tax expense (44,793) (40,252) Income tax expense (2) (2) Net loss $ (44,795) $ (40,254) Weighted average shares outstanding, basic and dluted 52,263,885 34,154,826 Basic and diluted net loss per share $ (0.86) $ (1.18) Copyright © 2020 Aqua Metals, Inc. All Rights Reserved. 28

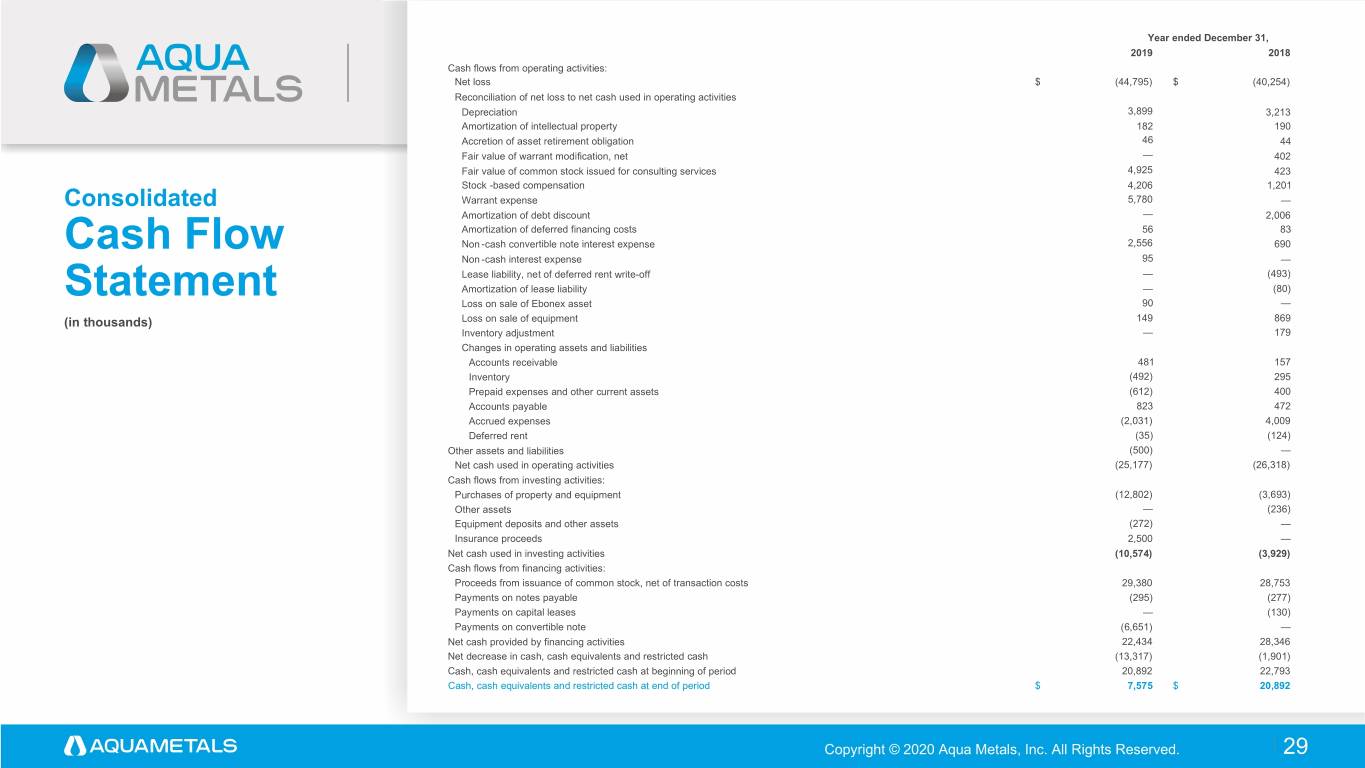

Year ended December 31, 2019 2018 Cash flows from operating activities: Net loss $ (44,795) $ (40,254) Reconciliation of net loss to net cash used in operating activities Depreciation 3,899 3,213 Amortization of intellectual property 182 190 Accretion of asset retirement obligation 46 44 Fair value of warrant modification, net — 402 Fair value of common stock issued for consulting services 4,925 423 Stock -based compensation 4,206 1,201 Consolidated Warrant expense 5,780 — Amortization of debt discount — 2,006 Amortization of deferred financing costs 56 83 Cash Flow Non -cash convertible note interest expense 2,556 690 Non -cash interest expense 95 — Lease liability, net of deferred rent write-off — (493) Statement Amortization of lease liability — (80) Loss on sale of Ebonex asset 90 — (in thousands) Loss on sale of equipment 149 869 Inventory adjustment — 179 Changes in operating assets and liabilities Accounts receivable 481 157 Inventory (492) 295 Prepaid expenses and other current assets (612) 400 Accounts payable 823 472 Accrued expenses (2,031) 4,009 Deferred rent (35) (124) Other assets and liabilities (500) — Net cash used in operating activities (25,177) (26,318) Cash flows from investing activities: Purchases of property and equipment (12,802) (3,693) Other assets — (236) Equipment deposits and other assets (272) — Insurance proceeds 2,500 — Net cash used in investing activities (10,574) (3,929) Cash flows from financing activities: Proceeds from issuance of common stock, net of transaction costs 29,380 28,753 Payments on notes payable (295) (277) Payments on capital leases — (130) Payments on convertible note (6,651) — Net cash provided by financing activities 22,434 28,346 Net decrease in cash, cash equivalents and restricted cash (13,317) (1,901) Cash, cash equivalents and restricted cash at beginning of period 20,892 22,793 Cash, cash equivalents and restricted cash at end of period $ 7,575 $ 20,892 Copyright © 2020 Aqua Metals, Inc. All Rights Reserved. 29

NASDAQ: AQMS WWW.AQUAMETALS.COM