United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

Filed by Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | | | | |

| [ ] | Preliminary Proxy Statement |

| | |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| [X] | Definitive Proxy Statement |

| | |

| [ ] | Definitive Additional Materials |

| | |

| [ ] | Soliciting Material Under Rule 14a-12 |

AQUA METALS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | | | |

| [ ] | Fee paid previously with preliminary materials: |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | | | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

April 16, 2020

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), to be held at the Company’s executive offices located at 160 Denmark Dr., McCarran, Nevada 89437, at 8:00 a.m. local time, on Tuesday, May 19, 2020.

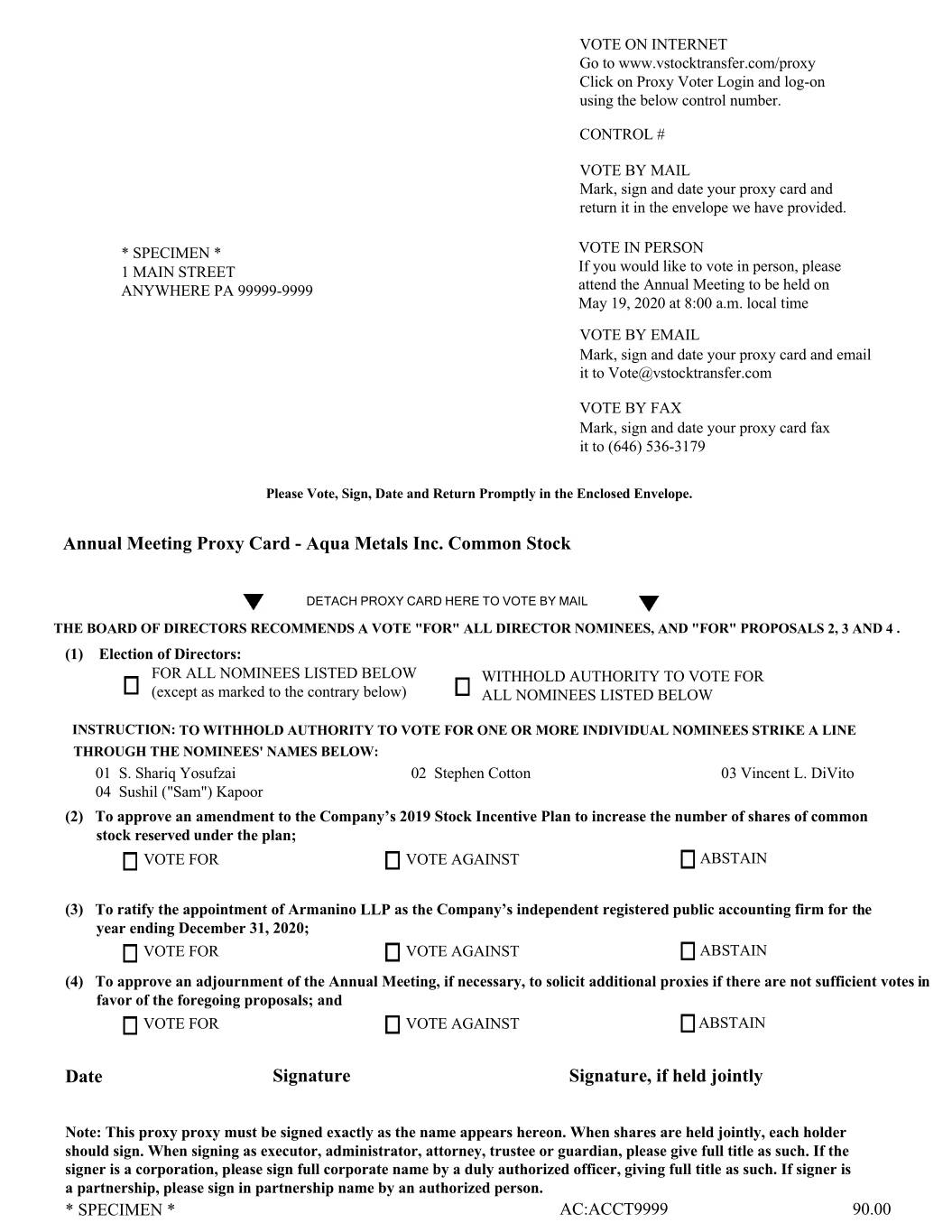

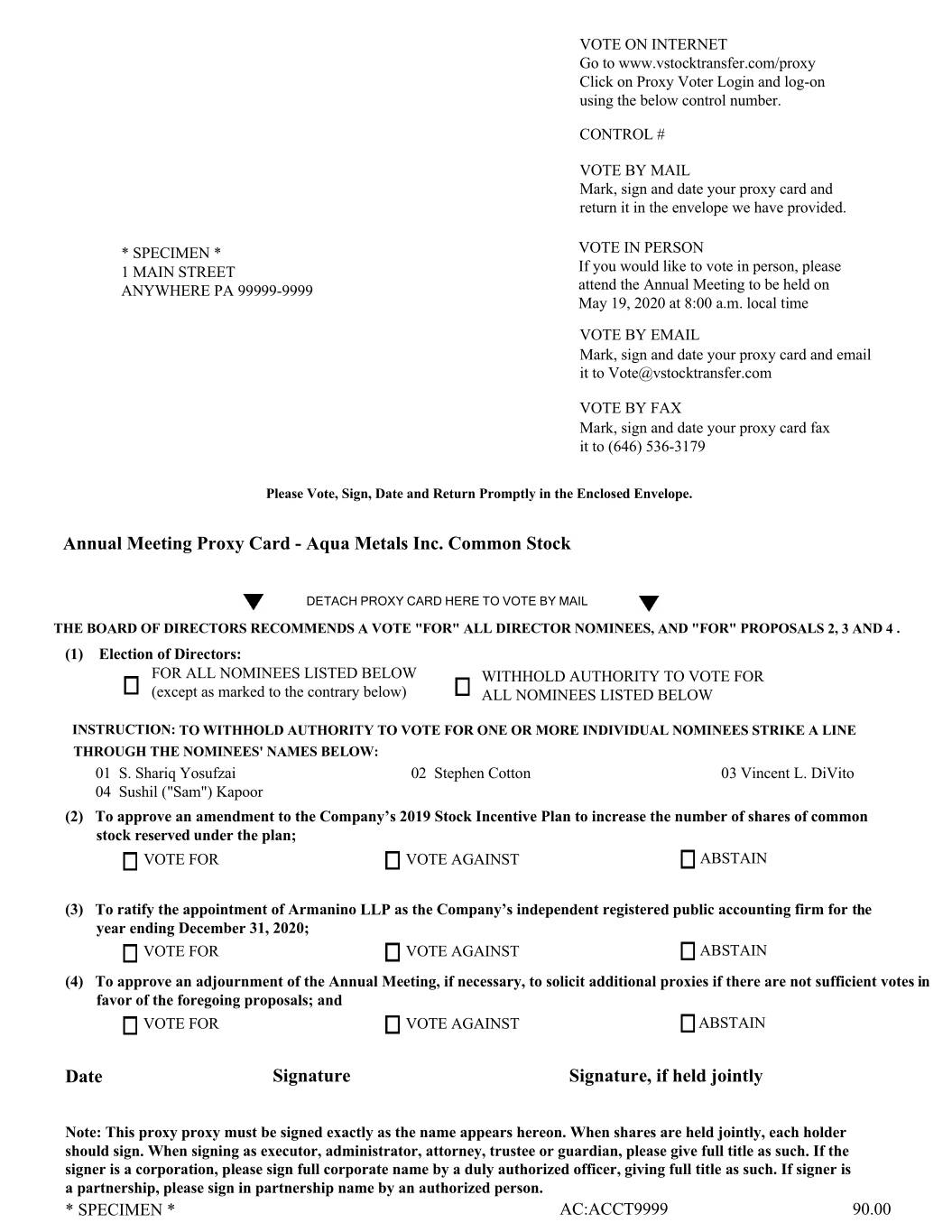

At the Annual Meeting, you will be asked to consider and vote upon the following proposals to: (1) elect four (4) directors to serve for the ensuing year as members of the Board of Directors of the Company; (2) approve an amendment to our 2019 Stock Incentive Plan to increase the number of shares of common stock reserved under the plan; (3) ratify the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020; (4) approve an adjournment to the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals; and (5) transact such other business as may properly come before the Annual Meeting or at any continuation, postponement or adjournment thereof. The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement describe these matters in more detail. We urge you to read this information carefully.

The Board of Directors recommends a vote: FOR each of the four (4) nominees for director named in the Proxy Statement, FOR the approval of an amendment to our 2019 Stock Incentive Plan to increase the number of shares of common stock reserved under the plan, FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020, and FOR an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals.

Whether or not you attend the Annual Meeting in person, and regardless of the number of shares of Aqua Metals, Inc. that you own, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to vote your shares of common stock via the Internet or by promptly marking, dating, signing, and returning the proxy card via mail or fax. Voting over the Internet, or by written proxy, will ensure that your shares are represented at the Annual Meeting.

On behalf of the Board of Directors of Aqua Metals, Inc., we thank you for your participation.

| | | | | |

| | Sincerely, |

| | |

| | S. Shariq Yosufzai |

| | Chairman of the Board |

AQUA METALS, INC.

2500 Peru Dr.

McCarran, Nevada 89437

(775) 525-1936

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2020

The 2020 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), will be at the Company’s executive offices located at 160 Denmark Dr., McCarran, Nevada 89437, at 8:00 a.m. local time, on Tuesday, May 19, 2020.

We will consider and act on the following items of business at the Annual Meeting:

| | | | | |

| 1. | To elect four (4) directors to serve as members of the Board of Directors of the Company (which we refer to as our “Board”) until the next annual meeting of stockholders and until their successors are duly elected and qualified. The director nominees named in the Proxy Statement for election to our Board are: S. Shariq Yosufzai, Stephen Cotton, Vincent L. DiVito and Sushil (“Sam”) Kapoor; |

| | |

| 2. | To approve an amendment to our 2019 Stock Incentive Plan to increase the number of shares of common stock reserved under the plan; |

|

|

| 3. | To ratify the appointment of Armanino LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020; |

| | |

| 4. | To approve an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals; and |

| |

| 5. | To transact such other business as may properly come before the Annual Meeting or at any continuation, postponement or adjournment thereof. |

The Proxy Statement accompanying this Notice describes each of these items of business in detail. Only stockholders of record at the close of business on April 7, 2020 are entitled to notice of, to attend, and to vote at, the Annual Meeting or any continuation, postponement or adjournment thereof.

To ensure your representation at the Annual Meeting, you are urged to vote your shares of common stock via the Internet or by promptly marking, dating, signing, and returning the proxy card via mail or fax. Voting instructions are printed on your proxy card and included in the accompanying Proxy Statement. Any stockholder attending the Annual Meeting may vote in person even if he or she previously submitted a proxy. If your shares of common stock are held by a bank, broker or other agent, please follow the instructions from your bank, broker or other agent to have your shares voted.

| | | | | |

| | Sincerely, |

| | S. Shariq Yosufzai |

| | Chairman of the Board |

McCarran, Nevada

April 16, 2020

| | |

Aqua Metals intends to hold its Annual Meeting in person. However, we are actively monitoring coronavirus (COVID-19) developments and related guidance issued by public health authorities. The health and well-being of Aqua Metals’ employees and stockholders are paramount. If it is determined that a change in the date, time or location of the Annual Meeting or a change to a virtual meeting format is advisable or required, an announcement of such changes will be made through a press release and on the Investor Relations page at www.ir.aquametals.com/. Please check this website in advance of the Annual Meeting date if you are planning to attend in person. |

TABLE OF CONTENTS

| | | | | |

| | Page |

| | |

| 1 |

| 1 |

| 1 |

| 1 |

| 2 |

| 3 |

| 3 |

| 4 |

| 4 |

| 5 |

| 6 |

| 6 |

| 6 |

| 7 |

| 9 |

| 9 |

| 9 |

| 10 |

| 11 |

| 11 |

| 12 |

| 13 |

| 13 |

| 13 |

| 13 |

| 13 |

| 14 |

Introduction | 14 |

Board Recommendation | 15 |

General | 15 |

Administration | 16 |

Options | 17 |

Restricted Stock Awards | 17 |

Restricted Stock Units | 17 |

Performance Awards | 17 |

Change in Control of Company | 18 |

Effect of Termination of Employment or Other Service | 19 |

| | | | | |

U.S. Income Tax Consequences | 19 |

| Equity Compensation Plan Information | 21 |

| PROPOSAL NO. 3 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 22 |

| Board Recommendation | 22 |

| Fees Incurred for Services by Principal Accountant | 22 |

| Pre-Approval Policies and Procedures | 22 |

| Audit Committee Report | 23 |

| PROPOSAL NO. 4 – APPROVE AN ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY, TO SOLICIT ADDITIONAL PROXIES IF THERE ARE NOT SUFFICIENT VOTES IN FAVOR OF PROPOSALS 1, 2 OR 3 | 24 |

Introduction | 24 |

Board Recommendation | 24 |

| 25 |

| 27 |

| 27 |

| 27 |

| 28 |

| 30 |

| 31 |

| 32 |

| 34 |

| 34 |

| 36 |

Delinquent Section 16(a) Reports | 36 |

| 36 |

| 36 |

| 37 |

| 37 |

| A-1 |

| |

| |

| |

| |

| |

AQUA METALS, INC.

2500 Peru Drive

McCarran, Nevada, 89437

(775) 525-1936

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 19, 2020

INFORMATION ABOUT THE ANNUAL MEETING

General

Your proxy is solicited on behalf of the Board of Directors (which we refer to as our “Board”) of Aqua Metals, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” or the “Company”), for use at our 2020 Annual Meeting of Stockholders (which we refer to as the “Annual Meeting”) to be held on May 19, 2020, at 8:00 a.m. local time at the Company’s executive offices located at 160 Denmark Dr., McCarran, Nevada 89437 or at any continuation, postponement or adjournment thereof, for the purposes discussed in this Proxy Statement and in the accompanying Notice of Annual Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting.

| | | | | | | | | | | | | | |

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on Tuesday, May 19, 2020 at 8:00 a.m. local time, at the Company’s executive offices located at 160 Denmark Dr., McCarran, Nevada 89437. The Annual Report, Notice of Meeting, Proxy Statement and Proxy Card are available at - http://investors.aquametals.com/ | | | | |

| | | | |

We intend to mail this Proxy Statement, the proxy card and the Notice of Annual Meeting on or about April 20, 2020 to all stockholders of record entitled to vote at the Annual Meeting. If you would like a hard copy of the Annual Report, Notice of Meeting, Proxy Statement and Proxy Card for this Annual Meeting, or any future stockholder meetings, mailed or emailed to you, please contact us at the above address or at our web page https://www.aquametals.com/contact-us/ or email us at frank@bristolir.com or telephone us at (800) 662-5200 For directions to the Annual Meeting, please telephone us at (800) 662-5200.

| | |

IMPORTANT NOTE: |

Aqua Metals intends to hold its Annual Meeting in person. However, we are actively monitoring coronavirus (COVID-19) developments and related guidance issued by public health authorities. The health and well-being of Aqua Metals’ employees and stockholders are paramount. If it is determined that a change in the date, time or location of the Annual Meeting or a change to a virtual meeting format is advisable or required, an announcement of such changes will be made through a press release and on the Investor Relations page at www.ir.aquametals.com/. Please check this website in advance of the Annual Meeting date if you are planning to attend in person. |

Who Can Vote, Outstanding Shares

Record holders of our common stock as of the close of business on April 7, 2020, the record date for the Annual Meeting, are entitled to vote at the Annual Meeting on all matters to be voted upon. As of the record date, there were 60,011,653 shares of our common stock outstanding, each entitled to one vote.

Voting of Shares

You may vote by attending the Annual Meeting and voting in person or you may vote by submitting a proxy. The method of voting by proxy differs for shares held as a record holder and shares held in “street name.”

If you hold your shares of common stock as a record holder, you may vote your shares over the Internet by following the instructions in the proxy card delivered to you or by completing, dating and signing the proxy card and promptly returning the proxy card via mail or facsimile. If you hold your shares of common stock in street name, which means that your shares are held of record by a broker, bank or other nominee, you will receive the notice from your broker, bank or other nominee that includes instructions on how to vote your shares.

If you are a stockholder of record, you may vote your shares as follows:

| | | | | | | | |

| | ● | To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. |

| | ● | To vote through the Internet, go to http://www.vstocktransfer.com/proxy to complete an electronic proxy card. You will be asked to provide the control number from the proxy card delivered to you. Your Internet vote must be received by 11:59 p.m., Eastern Time on May 18, 2020 to be counted. |

| | ● | To vote using the proxy card delivered to you, simply complete, sign, and date the proxy card and return it promptly in the envelope provided or either email it to Vote@stocktransfer.com or fax it to (646) 536-3179. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed. Any stockholder attending the Annual Meeting may vote in person even if he or she previously submitted a proxy.

All shares entitled to vote and represented by properly submitted proxies (including those submitted electronically and in writing) received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no direction is indicated on a proxy, your shares will be voted as follows:

● FOR each of the four (4) nominees for director named in the Proxy Statement, and

● FOR the approval of an amendment our 2019 Stock Incentive Plan to increase the number of shares of common stock reserved under the Plan, and

● FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020, and

● FOR an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of the foregoing proposals.

With respect to any other matter that properly comes before the Annual Meeting or any continuation, postponement or adjournment thereof, the proxy-holders will vote as recommended by our Board, or if no recommendation is given, in their own discretion.

Revocation of Proxy

If you are a stockholder of record, you may revoke your proxy at any time before your proxy is voted at the Annual Meeting by taking any of the following actions:

| | | | | | | | |

| | ● | delivering to our corporate secretary a signed written notice of revocation, bearing a date later than the date of the proxy, stating that the proxy is revoked; |

| | ● | signing and delivering a new proxy card, relating to the same shares and bearing a later date than the original proxy card; |

| | ● | submitting another proxy over the Internet (your latest Internet voting instructions are followed); or |

| | ● | attending the Annual Meeting and voting in person, although attendance at the Annual Meeting will not, by itself, revoke a proxy. |

Written notices of revocation and other communications with respect to the revocation of Company proxies should be addressed to:

Aqua Metals, Inc.

2500 Peru Drive

McCarran, Nevada 89437

Attention: Corporate Secretary

If your shares are held in “street name,” you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so. See below regarding how to vote in person if your shares are held in street name.

Voting in Person

If you plan to attend the Annual Meeting and wish to vote in person, you will be given a ballot at the Annual Meeting. Please note, however, that if your shares are held in “street name,” which means your shares are held of record by a broker, bank or other nominee, and you wish to vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the record holder of the shares, which is the broker or other nominee, authorizing you to vote at the Annual Meeting.

Stockholders who wish to attend the Annual Meeting will be required to present verification of ownership of our common stock, such as a bank or brokerage firm account statement, and will be required to present a valid government-issued picture identification, such as a driver’s license or passport, to gain admittance to the Annual Meeting. No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted in the Annual Meeting.

Quorum and Votes Required

The inspector of elections appointed for the Annual Meeting will tabulate votes cast by proxy or in person at the Annual Meeting. The inspector of elections will also determine whether a quorum is present. In order to constitute a quorum for the conduct of business at the Annual Meeting, a majority in voting power of all of the shares of the stock entitled to vote at the Annual Meeting must be present in person or represented by proxy at the Annual Meeting. Shares that abstain from voting on any proposal, or that are represented by broker non-votes (as discussed below), will be treated as shares that are present and entitled to vote at the Annual Meeting for purposes of determining whether a quorum is present.

A broker non-vote occurs when a broker, bank or other agent holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. Shares represented by proxies that reflect a broker non-vote will be counted for purposes of determining the presence of a quorum. We believe that the election of directors (Proposal 1) and the approval of an amendment to our 2019 Stock Incentive Plan (Proposal 2) will be considered non-routine matters and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. We believe that the ratification of the appointment of Armanino LLP as our independent registered public accounting firm (Proposal 3) and the proposal to adjourn the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1, 2 or 3 (Proposal 4) will be considered to be routine matters on which a broker, bank or other agent has discretionary authority to vote, so we do not expect any broker non-votes in connection with these proposals.

Proposal No. 1: Election of Directors. A plurality of the votes cast by the holders of shares entitled to vote in the election of directors at the Annual Meeting is required for the election of directors. Accordingly, the four (4) director nominees receiving the highest number of votes will be elected. Abstentions and broker non-votes are not treated as votes cast and, therefore, will not have any effect on the outcome of the election of directors.

Proposal No. 2: Approval of an Amendment to our 2019 Stock Incentive Plan. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval of an amendment to our 2019 Stock Incentive Plan to increase the number of shares reserved under the Plan. In the event of any broker non-votes or abstentions in connection with Proposal No. 2, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 3: Ratification of Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. Abstentions will not be counted either for or against this proposal. Brokers generally have discretionary authority to vote on the ratification of our independent registered public accounting firm and, therefore, broker non-votes are generally not expected to result from the vote on Proposal No. 3. However, in the event of any broker non-votes or abstentions in connection with Proposal No. 3, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

Proposal No. 4: Approval to Adjourn the Annual Meeting. The affirmative vote of the holders of a majority of the votes cast and entitled to vote at the Annual Meeting is required for the approval of an adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 1, 2 or 3. In the event of any broker non-votes or abstentions in connection with Proposal No. 4, such broker non-votes and abstentions will be counted as not present and these shares will be deducted from the total shares of which a majority is required.

We will also consider any other business that properly comes before the Annual Meeting, or any adjournment or postponement thereof. As of the record date, we are not aware of any other matters to be submitted for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, the persons named on the enclosed proxy card will vote the shares as recommended by our Board, or if no recommendation is given, in their own discretion.

Solicitation of Proxies

Our Board is soliciting proxies for the Annual Meeting from our stockholders. We will bear the entire cost of soliciting proxies from our stockholders. In addition to the solicitation of proxies by delivery of this Proxy Statement by mail, we will request that brokers, banks and other nominees that hold shares of our common stock, which are beneficially owned by our stockholders, send proxies and proxy materials to those beneficial owners and secure those beneficial owners’ voting instructions. We will reimburse those record holders for their reasonable expenses. We may use several of our regular employees, who will not be specially compensated, to solicit proxies from our stockholders, either personally or by Internet, facsimile or special delivery letter.

We have retained Morrow Sodali, LLC, a proxy solicitation firm, to perform various solicitation services in connection with the Annual Meeting. We will pay Morrow Sodali a fee not to exceed $5,000, plus phone and other related expenses, in connection with its solicitation services.

Stockholder List

A list of stockholders eligible to vote at the Annual Meeting will be available for inspection, for any purpose germane to the Annual Meeting, at the principal executive office of the Company during regular business hours for a period of no less than ten (10) days prior to the Annual Meeting.

Forward-Looking Statements

This Proxy Statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our 2019 Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

Who Can Answer Your Questions

Your vote at the Annual Meeting is important, no matter how many or how few shares you own. Please sign and date the enclosed proxy card and return it in the enclosed postage-paid envelope promptly or vote by Internet or telephone.

If you have any questions or need assistance in

voting your shares, please contact the Company’s proxy solicitor listed below:

MORROW SODALI, LLC

470 West Avenue, Suite 300

Stamford, CT 06902

(203) 658-9400

or

Call Toll-Free at 800-662-5200

Email: AQUA.info@morrowdali.com

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board Nominees

Our Board currently consists of five (5) members, four (4) of whom are independent under the listing standards for independence of the NASDAQ and under Rule 10A-3 under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”). Pursuant to our Second Amended and Restated Bylaws, our Board has approved that effective as of the close of the Annual Meeting the authorized number of directors shall be four (4). Based upon the recommendation of the Nominating and Corporate Governance Committee of our Board, our Board determined to nominate each of the Company’s current directors for re-election at the Annual Meeting except for Gayle J. Gibson who has chosen not to stand for re-election to the Board.

Our Board and the Nominating and Corporate Governance Committee believe the directors nominated collectively have the experience, qualifications, attributes and skills to effectively oversee the management of the Company, including a high degree of personal and professional integrity, an ability to exercise sound business judgment on a broad range of issues, sufficient experience and background to have an appreciation of the issues facing the Company, a willingness to devote the necessary time to Board duties, a commitment to representing the best interests of the Company and our stockholders and a dedication to enhancing stockholder value.

Each director elected at the Annual Meeting will serve a one (1) year term until the Company’s next annual meeting and until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Unless otherwise instructed, the proxy-holders will vote the proxies received by them for the four (4) nominees named below. If any of the nominees is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee designated by the present Board to fill the vacancy. It is not presently expected that any of the nominees named below will be unable or will decline to serve as a director. If additional persons are nominated for election as directors, the proxy-holders intend to vote all proxies received by them in a manner to assure the election of as many of the nominees listed below as possible. In such event, the specific nominees to be voted for will be determined by the proxy-holders.

Set forth below are the names, ages and positions of our director nominees as of the date of this Proxy Statement:

| | | | | | | | | | | | | | |

| Name | | Age | | Position with the Company |

| S. Shariq Yosufzai (a), (b), (c) | | 67 | | Chairman of the Board |

| Stephen Cotton | | 53 | | President and Chief Executive Officer |

| Vincent L. DiVito (a), (b), (c) | | 60 | | Independent Director |

| Sushil (“Sam”) Kapoor (a), (b), (c) | | 74 | | Independent Director |

(a) Member of the Audit Committee of our Board.

(b) Member of the Compensation Committee of our Board.

(c) Member of the Nominating and Corporate Governance Committee of our Board.

Board Recommendation

OUR BOARD RECOMMENDS A VOTE “FOR” EACH OF THE FOUR (4) NOMINEES

FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

Vacancies on our Board, including any vacancy created by an increase in the size of our Board, may be filled by a majority of the directors remaining in office (even though less than a quorum of our Board) or a sole remaining director, or by the stockholders. A director elected by our Board to fill a vacancy will serve until the

next annual meeting of stockholders and until such director’s successor is elected and qualified, or until such director’s earlier retirement, resignation, disqualification, removal or death.

If any nominee should become unavailable for election prior to the Annual Meeting, an event that currently is not anticipated by our Board, the proxies will be voted in favor of the election of a substitute nominee or nominees proposed by our Board. Each nominee has agreed to serve if elected and our Board has no reason to believe that any nominee will be unable to serve.

Information about Director Nominees

Set forth below is biographical information for each current member of our Board, including each nominee and a summary of the specific qualifications, attributes, skills and experiences which led our Board to conclude that each current member of our Board, including each nominee, should serve on our Board at this time. There are no family relationships among any of the directors or executive officers of the Company.

S. Shariq Yosufzai has served as a member of the Board since May 2, 2018. Mr. Yosufzai was most recently the Vice President, Global Diversity for the Chevron Corporation (“Chevron”)(CVX), a multinational energy corporation, from 2013 to March 2018. He held a number of positions at Chevron and its various affiliates, including Vice President (from 2010 to 2013); President of Chevron Global Marketing, a business unit within Chevron (from 2004 to 2010); Co-President of Chevron Products Company, North America, Chevron’s North America Refining & Marketing operations (from 2003 to 2004); and President of Chevron Texaco Global Lubricants (from 2001 to 2003). Prior to that, he worked at Caltex Corporation, a joint venture between Chevron and Texaco, Inc., as the Corporate Vice President, Caltex Corporation & President, Caltex Lubricants & New Business Development (from 2000 to 2001) and held a number of other senior level management positions at Caltex Corporation from 1998 to 2000. From 1991 to 1998, he worked at Texaco Inc., a subsidiary of Chevron, and served as the President of Texaco Lubricants Company from 1994 to 1998. As part of a joint enterprise between Texaco, Inc. and Saudi Aramco, Mr. Yosufzai was employed at Star Enterprise from 1988 to 1991 where he held a number of positions and prior to that began his career at Texaco, Inc., from 1975 to 1983. His past board memberships include Chairman of the Board of Directors of Caltex Lubricants Lanka Ltd.; Member of the Board of Directors of Caltex Australia Limited; and Member of the Management Committee of Star Enterprise. Mr. Yosufzai served as Chair of the Board of Directors of the American Institute of Chemical Engineering (AIChE) Foundation from November 2017 to 2020, Chair of the Board of Directors of the California Chamber of Commerce and is an Executive Committee Member of the San Francisco Opera’s Board of Directors. He previously served as Chair of the Board of the Association of Former Students of Texas A&M. Mr. Yosufzai also served as Executive Sponsor of Chevron’s University Partnership Program for the University of California, Berkeley, and Texas A&M University, and on the Advisory Board of Texas A&M’s Dwight Look College of Engineering and on the Chancellor’s Century Council of the Texas A&M University System. Named a Distinguished Graduate of the Chemical Engineering Department of Texas A&M University in 1998, in 1999 he became the first person to be honored by the school as both an Outstanding International Alumnus and a Distinguished Alumnus. In 2011, he served as Chair of the Board of the California Chamber of Commerce and was named an Outstanding Alumnus of the Dwight Look College of Engineering at Texas A&M. He attended Executive Education schools at both Columbia University, Graduate School of Business at Arden House and McIntire School of Commerce, University of Virginia and received his B.S. in Chemical Engineering from Texas A&M University.

Mr. Yosufzai has extensive managerial, operational and financial experience. As a result of these and other professional experiences, our Board has concluded that Mr. Yosufzai is qualified to serve as a director.

Stephen Cotton has served as our Chief Executive Officer since January 7, 2019 and President since May 2, 2018. Mr. Cotton previously served as Chief Commercial Officer of the Company from January 2015 to June 9, 2017. Previously, Mr. Cotton co-founded Canara, Inc. in December 2001 and served as its chief executive officer through the sale of the company to a private equity firm in June 2012, after which he served as executive chairman until April 2014. Canara is a global provider of stationary battery systems with integrated

monitoring systems and cloud-based monitoring services to many of the largest data center operators. From April 2014 to January 2015 and June 9, 2017 to the May 2, 2018, Mr. Cotton managed his private investments.

Mr. Cotton has extensive managerial and operational experience as a result of his executive officer positions with Canara and the Company. As a result of these and other professional experiences, our Board has concluded that Mr. Cotton is qualified to serve as a director.

Vincent L. DiVito has served as a member of our Board since May 2015. From April 19, 2018 to May 2, 2018, Mr. DiVito served as non-executive Chairman of the Board. Since April 2010, Mr. DiVito has served as the owner and chief executive officer of Vincent L. DiVito, Inc., a financial and management consulting firm. From January 2008 to April 2010, Mr. DiVito served as president of Lonza America, Inc., a global life sciences chemical business headquartered in Allendale, New Jersey, and also served as chief financial officer and treasurer of Lonza America, Inc. from September 2000 to April 2010. Lonza America, Inc. is part of Lonza Group, whose stock is traded on the Swiss Stock Exchange. From 1990 to September 2000, Mr. DiVito was employed by Algroup Wheaton, a global pharmaceutical and cosmetics packaging company, first as its director of business development and later as its vice president and chief financial officer. Mr. DiVito is a certified public accountant, certified management accountant and holds an MBA in Finance. Mr. DiVito is a National Association of Corporate Directors Board Leadership Fellow. He served on the board of directors and chairman of the audit committee of Entertainment Gaming Asia Inc., a Nasdaq listed gaming company, from October 2005 until its acquisition in July 2017, and also served as a member of the board of directors of Riviera Holdings Corporation, formerly an AMEX listed gaming and resort company, from July 2002 until the consummation of a change in control of the corporation in March 2011.

Mr. DiVito has extensive knowledge of accounting and corporate governance issues from his experience serving on various corporate boards of directors and has extensive operational knowledge as a result of his experience as a senior executive officer of major corporations. As a result of these and other professional experiences, our Board has concluded that Mr. DiVito is qualified to serve as a director.

Sushil (“Sam”) Kapoor, has served as a member of the Board since May 2, 2018. Mr. Kapoor was the Chief Global Operations Officer of Equinix, Inc., a multinational company that specializes in internet connection and related services, since January 2008 until March 2018. As the Chief Operations executive at Equinix, Inc. since early 2001, Mr. Kapoor played a major role in steering the company from near bankruptcy to its current industry leading position. During this period Equinix, Inc. grew from 7 data centers in 6 markets in one country with annual revenue of less than $20 million to more than 180 data centers in 44 metros across 25 major countries spread over 4 continents with annual revenues exceeding $5 Billion. During the same period, the stock price grew from a split adjusted low of around $5 to its current price of more than $400. Mr. Kapoor served as Vice President of Operations of Equinix, Inc., from March 2001 to December 2006 and also served as its Senior Vice President of IBX Operations from December 2006 to January 2008. Prior to joining Equinix, Mr. Kapoor served as Vice President of hosting operations at UUNET Technologies, Inc., the Internet division of MCI (formerly known as WorldCom) from November 1999 to February 2001. He was responsible for the build-out and day-to-day operations of six hosting centers. From May 1995 to November 1999, he served as Vice President, Global Network Technology for Compuserve Network Services, an Internet access provider. Mr. Kapoor served as Senior Director of Telecommunications for over 10 years at Lexis-Nexis in Miamisburg. Mr. Kapoor holds an M.B.A. (Operations Research) from Miami University of Ohio and an M.S. in Electrical Engineering from the University of Cincinnati.

Mr. Kapoor has extensive operational and managerial experience from serving as an executive officer at several major companies. As a result of these and other professional experiences, our Board has concluded that Mr. Kapoor is qualified to serve as a director.

Gayle J. Gibson has served as a member of our Board since January 30, 2019. As noted above, Ms. Gibson has chosen not to stand for re-election to the Board and her service on the Board shall conclude upon the Annual Meeting. Ms. Gibson served in several executive positions with E. I. du Pont de Nemours and Company during a 34-year career with DuPont, and retired from DuPont in November 2017 as the head of central

engineering. Most recently, Ms. Gibson served as Director, Engineering at DuPont from January 2016 to October 2017 and as Director, Engineering Technology from January 2014 to December 2015. Ms. Gibson was instrumental in the engineering organizational planning for the merged DowDuPont, Inc. and future planned spin-off companies. Prior to her leadership roles in engineering, she was chief of staff to the Chair of the Board and Chief Executive Officer of DuPont from 2008 to 2013 where she led operating processes for the top three levels of leadership. During her tenure, she supported a CEO succession, major acquisitions and divestitures, reorganization and company restructuring. Ms. Gibson serves on the Heritage Council of the Science History Institute and on the Engineering Advisory Council for Texas A&M University. She received the Management Division Award from the American Institute of Chemical Engineers in 2018 where she is a Fellow. Ms. Gibson served on the Board of Directors of the National Action Council for Minorities in Engineering from 2016 to 2017. She was on two project committees for the National Academy of Engineering. Ms. Gibson is a certified Six Sigma Champion with an International M.B.A. from European University and a B.S. in Chemical Engineering from Texas A&M University.

Ms. Gibson has extensive managerial, operational and engineering experience as a result of her several leadership roles with DuPont. As a result of these and other professional experiences, our Board has concluded that Ms. Gibson is qualified to serve as a director.

CORPORATE GOVERNANCE

Board Composition

Our Board may establish the authorized number of directors from time to time by resolution. Our Board currently consists of five (5) authorized members, however pursuant to our Second Amended and Restated Bylaws, our Board has approved that effective as of the close of the Annual Meeting the authorized number of directors shall be four (4). During the year ended December 31, 2019, our Board met seven times. All of our Board members attended at least 75% of the aggregate of all Board meetings and all meetings of the Board committees upon they served held while they were on the Board during fiscal 2019. Our Board does not have a policy regarding Board members’ attendance at meetings of our stockholders and five members of our Board attended our prior year’s annual meeting of stockholders.

Generally, under the listing requirements and rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s board of directors. Our Board has undertaken a review of its composition, the composition of its committees and the independence of each director. Our Board has determined that, other than Mr. Cotton, by virtue of his executive officer position, none of our director nominees has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each is “independent” as that term is defined under the applicable rules and regulations of the SEC and the listing requirements and rules of the Nasdaq Stock Market. In making this determination, our Board considered the current and prior relationships that each nonemployee director nominee has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each nonemployee director nominee. Accordingly, a majority of our directors are independent, as required under applicable Nasdaq Stock Market rules, as of the date of this Proxy Statement.

Director Resignation Policy

On September 21, 2018, the Board adopted the Director Resignation Policy, whereby, commencing with respect to our 2019 annual meeting (and at each subsequent annual meeting of the Company’s stockholders at which directors of the Company are to be elected), any director who fails to receive a majority of the votes cast by the Company’s stockholders at such meeting “for” his or her election as a Company director immediately shall (after the final tabulation and certification by the Company’s inspector of elections of voting results), tender his or her resignation to the Nominating and Corporate Governance Committee or Nominating Committee, for its consideration and acceptance or rejection.

The Board adopted the Director Resignation Policy to address the situation in which a nominee for the Board is elected to the Board in an uncontested election despite receiving more votes “withheld” from or “against” his or her election than votes “for” his or her election (a “majority withheld vote”). For purposes of the policy, an “uncontested election” is any election of Company directors in respect of which the number of director- nominees for election is less than or equal to the number of directors to be elected.

By accepting a nomination for election and agreeing to serve as a director of the Company in any uncontested election of Company directors, each nominee agrees that if he or she receives a majority withheld vote in any such election, such director promptly shall tender to the Board an offer of his or her resignation as a Company director following certification of the stockholder vote by the inspector(s) of election at the meeting for such uncontested election. Any director who offers his or her resignation pursuant to this policy will not participate in any discussions, deliberations or actions by either the Nominating Committee or the full Board with respect to his or her own resignation offer, but will otherwise continue to serve as a director unless and until such resignation is accepted and effective.

The Nominating Committee will duly consider and recommend to the full Board whether to accept or reject the resignation offer received from each director who received a majority withhold vote. Following the recommendation of the Nominating Committee, the independent members of the Board will make a determination of the action to take with respect to the offer of resignation, not later than the 90th day immediately succeeding the date of the written certification of the shareholder vote by said inspector(s) of election. The Nominating Committee and the Board will evaluate any such tendered offer of resignation, in accordance with their fiduciary duties to, and in furtherance of the best interests of, the Company and its stockholders. The Board may accept or reject the offer of resignation, or it may decide to pursue additional actions, including, without limitation, the following:

| | | | | | | | |

| | ● | allow the director to remain on the Board and continue to serve but not be nominated for re-election to the Board at the next election of directors; |

| | ● | defer the acceptance of the resignation until the director vacancy the resignation will create can be filled by the Board with a replacement/successor - director meeting all the necessary qualifications and criteria for Company directors and/or satisfying other legal and regulatory requirements with respect to the composition of the Board (for purposes of illustration, such as “independence” requirements established by Securities and Exchange Commission regulations or securities exchange listing requirements); or |

| | ● | defer the acceptance of the resignation if it is determined that the underlying cause of the majority withheld vote can be cured by the director or otherwise within a specified period of time (for purposes of illustration, if the majority withhold vote was due to the relevant director receiving such vote serving on the board of directors of another entity, by resigning from such other board). |

The Board’s decision will be disclosed in a Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission within four business days after the decision. If the Board has decided to reject the tendered resignation, or to pursue any additional action other than accepting the tendered resignation (as described above or otherwise), then the Current Report on Form 8-K will fully disclose the Board’s reasons for doing so.

Committees of the Board of Directors

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. During 2019, we also had an Executive Development and Succession Committee, the principal purpose of which was to assist in the development of our executive officers and to plan for their succession, however our Board terminated the committee in January 2020 and transferred the authorities and obligations of the Executive Development and Succession Committee to the Nominating and Corporate Governance Committee. Our Board may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until

their resignation or until otherwise determined by our Board. Each of our committees operates under a written charter, a copy of which is available at our investor relations website is located at https://ir.aquametals.com.

Audit Committee

Our Audit Committee consists of Vincent DiVito, Shariq Yosufzai, and Sam Kapoor, with Mr. DiVito serving as Chairperson. The composition of our Audit Committee meets the requirements for independence under current Nasdaq Stock Market listing standards and SEC rules and regulations. Each member of our Audit Committee meets the financial literacy requirements of the Nasdaq Stock Market listing standards. Mr. DiVito is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the Securities Act of 1933, as amended, or the Securities Act. Our Audit Committee will, among other things:

| | | | | | | | |

| | ● | select a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; |

| | ● | discuss the scope and results of the audit with the independent registered public accounting firm, and review, with management and the independent registered public accounting firm, our interim and year-end operating results; |

| | ● | develop procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| | ● | review our policies on risk assessment and risk management; |

| | ● | review related-party transactions; and |

| | ● | approve (or, as permitted, pre-approve) all audit and all permissible nonaudit services, other than de minimis nonaudit services, to be performed by the independent registered public accounting firm. |

Our Audit Committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the Nasdaq Stock Market. During the year ended December 31, 2019, our Audit Committee met four times.

Compensation Committee

Our Compensation Committee consists of Sam Kapoor, Shariq Yosufzai, Vincent DiVito and Gayle Gibson, with Mr. Kapoor serving as Chairperson. The composition of our Compensation Committee meets the requirements for independence under the Nasdaq Stock Market listing standards and SEC rules and regulations. Each member of the Compensation Committee is also a nonemployee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, as amended, or the Code. The purpose of our Compensation Committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Our Compensation Committee will, among other things:

| | | | | | | | |

| | ● | review, approve and determine the compensation of our executive officers; |

| | ● | administer our stock and equity incentive plans; |

| | ● | make recommendations to our Board regarding director compensation and the establishment and terms of incentive compensation and equity plans; and |

| | ● | establish and review general policies relating to compensation and benefits of our employees. |

Our chief executive officer may, from time to time, provide input and recommendation to our Compensation Committee concerning the compensation of our other executive officers. Our chief executive officer may also, from to time, attend Compensation Committee meetings, but he is not present during the Committee’s deliberations regarding executive officer compensation. From time to time, our Compensation Committee may use an independent consultant in considering compensation policies and programs for executive officers, however our Compensation Committee did not engage an independent consultant during fiscal 2019. Our Compensation Committee operates under a written charter that satisfies the applicable rules of the SEC and

the listing standards of the Nasdaq Stock Market. During the year ended December 31, 2019, our Compensation Committee met eight (8) times.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee consists of S. Shariq Yosufzai, Vincent DiVito, Sam Kapoor and Gayle Gibson, with Mr. Yosufzai serving as Chairperson. The composition of our Nominating and Corporate Governance Committee meets the requirements for independence under Nasdaq Stock Market listing standards and SEC rules and regulations. Our Nominating and Corporate Governance Committee will, among other things:

| | | | | | | | |

| | ● | identify, evaluate and make recommendations to our Board regarding nominees for election to our board of directors and its committees; |

| | ● | evaluate the performance of our Board and of individual directors; |

| | ● | consider and make recommendations to our Board regarding the composition of our Board and its committees; |

| | ● | review developments in corporate governance practices; |

| | ● | evaluate the adequacy of our corporate governance practices and reporting; |

| ● | assist in the development of our executive officers; |

| ● | develop and oversee a plan for succession to the position of Chief Executive Officer and other senior management positions; and |

| | ● | develop and make recommendations to our Board regarding corporate governance guidelines and matters. |

Our Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including the ability to read and understand basic financial statements, being over 21 years of age, and having the highest personal integrity and ethics. The committee also considers such factors as diversity, an individual’s business experience and skills, independence, judgment, integrity and ability to commit sufficient time and attention to the activities of the Board, as well as the absence of any potential conflicts with our Company’s interests. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the Board, the operating requirements of our company, and the long-term interests of our stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee typically considers diversity, age, skills, and such other factors as it deems appropriate, given the current needs of the Board and our Company, to maintain a balance of knowledge, experience, and capability. Our Nominating and Corporate Governance Committee conducts an annual assessment of the Committee’s charter and the performance of the committee under the charter and the above standards.

Our Nominating and Corporate Governance Committee will consider for directorship candidates nominated by third parties, including stockholders. However, at this time, our Nominating and Corporate Governance Committee does not have a policy with regard to the consideration of director candidates recommended by stockholders. The Nominating and Corporate Governance committee believes that it is in the best position to identify, review, evaluate, and select qualified candidates for Board membership, based on the comprehensive criteria for Board membership approved by the Board. For a third party to suggest a candidate, one should provide our corporate secretary, Judd Merrill, with the name of the candidate, together with a brief biographical sketch and a document indicating the candidate’s willingness to serve if elected.

The Nominating and Corporate Governance Committee operates under a written charter that satisfies the applicable listing requirements and rules of the Nasdaq Stock Market. During the year ended December 31, 2019, our Nominating and Corporate Governance Committee met four (4) times.

Board Leadership Structure and Role in Risk Oversight

While we have not adopted a formal policy on whether the chairman and chief executive officer positions should be separate or combined, our Board has appointed S. Shariq Yosufzai to serve as Non-Executive Chairman and the lead independent director of the Board in order to effectively separate the roles of chairman and chief executive officer. Our Board has an active role in overseeing our areas of risk. While the full Board has overall responsibility for risk oversight, the Board has assigned certain areas of risk primarily to designated committees, which report back to the full Board.

Process for Stockholders to Send Communications to our Board of Directors

Because we have always maintained open channels of communication with our stockholders, we do not have a formal policy that provides a process for stockholders to send communications to our Board. However, if a stockholder would like to send a communication to our Board, please address the letter to the attention of our corporate secretary, Judd Merrill, and it will be distributed to each director.

Compensation Committee Interlocks and Insider Participation

None of our independent directors, S. Shariq Yosufzai, Vincent L. DiVito, Gayle J. Gibson or Sam Kapoor is currently or has been at any time one of our officers or employees. None of our executive officers currently serves, or has served during the last year, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board.

Employee, Officer and Director Hedging

We have adopted a policy that no director, officer, employee or consultant of the Company may engage in any short term or speculative transactions involving securities of the Company. These prohibited speculative transactions include short sales, publicly traded options, hedging transactions, margin accounts and pledged securities, and standing and limit orders.

Code of Conduct

We have adopted a code of conduct for all employees, including the chief executive officer, principal financial officer and principal accounting officer or controller, and/or persons performing similar functions, which is available on our website, under the link entitled “Code of Conduct”.

Limitation of Liability of Directors and Indemnification of Directors and Officers

The Delaware General Corporation Law provides that corporations may include a provision in their certificate of incorporation relieving directors of monetary liability for breach of their fiduciary duty as directors, provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful payment of a dividend or unlawful stock purchase or redemption, or (iv) for any transaction from which the director derived an improper personal benefit. Our Amended and Restated Certificate of Incorporation provides that directors are not liable to us or our stockholders for monetary damages for breach of their fiduciary duty as directors to the fullest extent permitted by Delaware law. In addition to the foregoing, our Amended and Restated Bylaws provide that we may indemnify directors, officers, employees or agents to the fullest extent permitted by law and we have agreed to provide such indemnification to each of our directors.

The above provisions in our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and in the written indemnity agreements may have the effect of reducing the likelihood of derivative litigation against directors and may discourage or deter stockholders or management from bringing a

lawsuit against directors for breach of their fiduciary duty, even though such an action, if successful, might otherwise have benefited us and our stockholders. However, we believe that the foregoing provisions are necessary to attract and retain qualified persons as directors.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

PROPOSAL NO. 2

AUTHORIZE AND APPROVE AN AMENDMENT

TO OUR 2019 STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF

SHARES OF COMMON STOCK RESERVED UNDER THE PLAN

Introduction

Rule 5635(c) of the Nasdaq Listing Rules requires stockholder approval for the establishment or material amendment of any equity compensation arrangement, with limited exceptions. We are seeking the approval of our stockholders in accordance with Rule 5635(c) of the Nasdaq Listing Rules for of an amendment to our 2019 Stock Incentive Plan (the “2019 Plan”) to increase the number of shares under the 2019 Plan. Our Board has approved the amendment to the 2019 Plan and recommends the approval of the amendment to the 2019 Plan by our stockholders.

The 2019 Plan was originally adopted by our stockholders on March 27, 2019 and, at that time, we initially reserved 4,500,000 shares of our common stock under the 2019 Plan. As of March 27, 2020, we have issued a total of 4,424,118 shares of common stock and options to purchase shares of common stock under the 2019 Plan.

Our Board has reviewed the 2019 Plan and the lack of available shares thereunder and determined that the 2019 Plan requires additional shares to provide the flexibility with respect to stock-based compensation that our Board believes is necessary to establish appropriate long-term incentives to achieve our objectives. Our Board believes that it is advisable to increase the share limit in the 2019 Plan by 7,000,000 shares, from 4,500,000 shares to 11,500,000 shares, in order to attract and compensate employees, officers, directors and others upon whose judgment, initiative and effort we depend. The issuance of common shares and stock options to eligible participants is designed to align the interests of such participants with those of our stockholders.

The 2019 Plan increases the number of shares of common stock that may be issued under the 2019 Plan by 7,000,000 shares, or approximately 11.8% of the 59,790,798 shares of common stock outstanding on March 27, 2020. The closing price per-share of our common stock on April 14, 2020 was $0.63. The major features of the 2019 Plan are summarized below. This summary is qualified in its entirety by reference to the full text of the 2019 Plan, a copy of which is attached to this Proxy Statement as APPENDIX A.

As described in the section “Executive Officers and Compensation - Narrative Disclosure to Summary Compensation Table”, on March 23, 2020 the Compensation Committee of our Board approved the issuance of an aggregate of 1,970,475 Restricted Stock Units, or RSUs, to our executive officers and one other employee of the Company, subject to and conditioned upon the approval of the amendment to the 2019 Plan to increase the number of shares under the 2019 Plan. The RSUs approved for issuance by our Compensation Committee, subject to the stockholders’ approval of the amendment of the 2019 Plan, are as follows:

| | | | | | | | |

| Name and Position of Grantee | Dollar Value | Number of RSUs |

| Stephen Cotton, CEO | $447,525 | | 1,316,250 |

| Judd Merrill, CFO | $169,065 | | 497,250 |

| Executive Group (two officers) | $616,590 | | 1,813,500 |

| Non-Executive Officer (one employee) | $53,372 | | 156,975 |

(1) Dollar amounts reflect the aggregate fair value of each RSU award computed in accordance with the provisions of FASB ASC Topic 718, using the closing price of our common stock on the date of approval by the Compensation Committee.

The RSU grants were approved by the Compensation Committee of our Board, however, the RSUs have not been awarded and will not be awarded unless and until our stockholders approve the proposed amendment to the 2019 Plan at this Annual Meeting. Subject to the approval of the amendment to the 2019 Plan by our stockholders at this Annual Meeting, the RSUs will be granted under the 2019 Plan. Each RSU shall entitle its holder to receive one share of our common stock upon settlement of the RSU. The RSUs will settle in six equal semi-annual installments over a three period, subject to the recipient’s continuation of service to our Company. The income tax consequences to the Company, Mr. Cotton, Mr. Merrill and the other employee of the grant and settlement of the RSUs are summarized below under “U.S. Income Tax Consequences – Restricted Stock Units.”

Board Recommendation

OUR BOARD RECOMMENDS A VOTE “FOR” AN AMENDMENT

TO OUR 2019 STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF

SHARES OF COMMON STOCK RESERVED UNDER THE PLAN

General

The 2019 Plan is intended to advance the interests of the Company and our stockholders by enabling us to attract and retain qualified individuals through opportunities for equity participation, and to reward those individuals who contribute to the achievement of our economic objectives. The 2019 Plan allows us to award eligible recipients incentive awards, consisting of:

| | | | | | | | |

| ● | options to purchase shares of our common stock, which may be “incentive options” that qualify as “incentive stock options” within the meaning of Section 422 of the Internal Revenue Code; |

| ● | “non-statutory stock options” that do not qualify as incentive options; |

| ● | “restricted stock awards” which are shares of common stock that are subject to certain forfeiture and transferability restrictions; |

| ● | “restricted stock units,” which are contractual obligations to issue shares of common stock to participants once vesting criteria are satisfied; and |

| ● | “performance stock awards” which are shares of common stock or cash that may be subject to the future achievement of certain performance criteria or be free of any performance or vesting. |

All of our employees and any subsidiary employees (including officers and directors who are also employees), as well as all of our non-employee directors and other consultants, advisors and other persons with whom we have a relationship will be eligible to receive incentive awards under the Plan. As of March 27, 2020, there were approximately 21 employees, five non-employee directors and an indeterminate number of consultants, advisors or other persons with whom we have a relationship eligible to participate in the Plan.

Shares that are issued under the 2019 Plan or that are subject to outstanding incentive awards reduce the number of shares remaining available under the Plan. Any shares subject to an incentive award that lapses,

expires, is forfeited, terminates unexercised or unvested, or is settled or paid in cash or other consideration will automatically again become available for issuance under the Plan.

If the exercise price of any option or any associated tax withholding obligations are paid by a participant’s tender or attestation as to ownership of shares (as described below), or if tax withholding obligations are satisfied by the Company withholding shares otherwise issuable upon exercise of an option, only the net number of shares issued will reduce the number of shares remaining available under the Plan.

In the event of any reorganization, merger, consolidation, recapitalization, liquidation, reclassification, stock dividend, stock split, combination of shares, rights offering, divestiture or extraordinary dividend (including a spin-off) or any other similar change in the corporate structure or shares of the Company, appropriate adjustment will be made to:

| | | | | | | | |

| ● | the number and kind of securities available for issuance under the Plan; |

| ● | the limits on the numbers of shares that may be granted to a participant within any fiscal year or that may be granted as restricted stock awards under the Plan; and |

| ● | in order to prevent dilution or enlargement of the rights of participants, the number, kind and, where applicable, the exercise price of securities subject to outstanding incentive awards. |

Administration

The 2019 Plan will be administered by our Compensation Committee. We refer to the Compensation Committee administering the 2019 Plan as the “Committee.”

The Committee has the authority to determine all necessary or desirable provisions of incentive awards, including, the eligible recipients who will be granted one or more incentive awards under the Plan, the nature and extent of the incentive awards to be made to each participant, the time or times when incentive awards will be granted, the duration of each incentive award, and payment or vesting restrictions and other conditions. The Committee has the authority to amend or modify the terms of outstanding incentive awards (including any “repricing” of options) so long as the amended or modified terms are permitted under the 2019 Plan and any affected participant has consented to the amendment or modification.

The 2019 Plan became effective on February 12, 2019 and, unless terminated earlier, the 2019 Plan will terminate at midnight on February 12, 2029. Incentive awards outstanding at the time the 2019 Plan is terminated may continue to be exercised, or become free of restriction, according to their terms. The Board may suspend or terminate the 2019 Plan or any portion of the 2019 Plan at any time, and may amend the 2019 Plan from time to time to conform incentive awards to any change in applicable laws or regulations or in any other respect that the board may deem to be in our best interests. However, no amendments to the 2019 Plan will be effective without stockholder approval if it is required under Section 422 of the Internal Revenue Code or the Listing Rules of the Nasdaq.

Termination, suspension or amendment of the 2019 Plan will not adversely affect any outstanding incentive award without the consent of the affected participant, except for adjustments in the event of changes in capitalization or a “change in control,” discussed below.

In general, no right or interest in any incentive award may be assigned or transferred by a participant, except by will or the laws of descent and distribution, or subjected to any lien or encumbrance. However, the Committee may permit a participant to transfer of all or a portion of a non-statutory stock option, other than for value, to certain family members or related family trusts, foundations or partnerships. Any permitted transferee of a non-statutory stock option will remain subject to all the terms and conditions of the incentive award applicable to the participant.

Options

The exercise price of an incentive stock option may not be less than 100% of the fair market value of a share of our common stock on the option grant date (or 110% if the participant beneficially owns more than 10% of our outstanding stock). Under the Plan, “fair market value” means the average of the reported high and low sale prices of a share of our common stock during the regular daily trading session on the Nasdaq Stock Market.

In general, the 2019 Plan requires a participant to pay an option’s exercise price in cash. The Committee may, however, allow exercise payments to be made, in whole or in part, by delivery of a broker exercise notice (pursuant to which a broker or dealer is irrevocably instructed to sell enough shares or loan the optionee enough money to pay the exercise price and to remit such sums to the company), by tender or attestation as to ownership of shares of common stock that have been held for the period of time necessary to avoid a charge to the Company’s earnings for financial reporting purposes and that are otherwise acceptable to the Committee, or by a combination of such methods. Any shares of common stock tendered or covered by an attestation will be valued at their fair market value on the exercise date.

The aggregate fair market value of shares of common stock with respect to which incentive stock options may become exercisable by a participant for the first time during any calendar year (and under all “incentive stock option” plans of the company or any subsidiary) may not exceed $100,000. Any incentive stock options in excess of this amount will be treated as non-statutory stock options. Options may be exercised in whole or in installments, as determined by the Committee, and the Committee may impose conditions or restrictions to the exercisability of an option, including that the participant remain continuously employed by the Company or a subsidiary for a certain period. An option may not remain exercisable after 10 years from its date of grant (or five years from its date of grant if the participant beneficially owns more than 10% of our outstanding stock).

Restricted Stock Awards

A restricted stock award is an award of common stock vesting at such times and in such installments as may be determined by the Committee and, until it vests, that is subject to restrictions on transferability and the possibility of forfeiture. Restricted stock awards may be subject to any restrictions or vesting conditions that the Committee deems appropriate, including that the participant remain continuously employed by the Company or a subsidiary for a certain period.

Unless the Committee determines otherwise, any dividends (other than regular quarterly cash dividends) or distributions paid with respect to shares of common stock subject to the unvested portion of a restricted stock award will be subject to the same restrictions as the shares to which such dividends or distributions relate. Holders of restricted stock awards will have the same voting rights as holders of unrestricted common stock.

Restricted Stock Units

A restricted stock unit is an award that represents a promise to issue to the participant shares of common stock once certain criteria specified in the award are satisfied. The criteria may be that the participant remain employed until a specified date or dates or that various performance objectives are satisfied. No stock ownership rights are conferred upon the participant until the restricted stock unit awards are settled upon the satisfaction of the specified criteria.

Performance Awards

The 2019 Plan permits the grant of performance-based stock and cash awards. The Committee may structure awards so that the stock or cash will be issued or paid only following the achievement of certain pre-established performance goals during a designated performance period.

The Committee may establish performance goals by selecting from one or more performance criteria set forth in the Plan, including, but not limited to: earnings before interest, taxes, depreciation and amortization; total stockholder return; return on equity or average stockholders’ equity; return on assets, investment, or capital employed; stock price margin (including gross margin); income (before or after taxes); operating income (before or after taxes); pre-tax profit; operating cash flow; sales or revenue targets; increases in revenue; expenses and cost reduction goals; improvement in or attainment of working capital levels; economic value added; market share; cash flow (including cash flow per share); share price performance; debt reduction; strategic partnerships and transactions; stockholders’ equity; capital expenditures; operating profit or net operating profit; growth of net income or operating income; budget management; plant performance, contribution margin and other measures of performance selected by the Committee.

Change in Control of the Company

In the event a “change in control” of the Company occurs, then, if approved by the Committee (either at the time of the grant of the incentive award or at any time thereafter):

| | | | | | | | |

| ● | outstanding options that may become immediately exercisable in full and will remain exercisable in accordance with their terms, |

| ● | outstanding restricted stock awards and restricted stock units may become immediately fully vested and non-forfeitable; and |

| | ● | any conditions to the issuance of cash or shares of common stock pursuant to performance awards may lapse. |

The Committee may also determine that some or all participants holding outstanding options will receive shares or a cash payment equal to the excess of the fair market value of the option shares immediately prior to the effective date of the change in control over the exercise price per share of the options (or, in the event that there is no excess, that such options will be terminated).

For purposes of the 2019 Plan a “change in control” of the Company generally occurs if:

| | | | | | | | | | | |

| ● | all or substantially all of our assets are sold, leased, exchanged or transferred to any successor; | |

| ● | our stockholders approve any plan or proposal to liquidate or dissolve the Company; | |

| ● | a person previously unaffiliated with our Company, other than a bona fide underwriter in a securities offering, becomes the beneficial owner of 25% or more, but not 50% or more, of our outstanding securities ordinarily having the right to vote at elections of directors, unless the transaction has been approved in advance by “continuity directors,” who are members of our Board at the time of the Annual Meeting or whose nomination for election meets certain approval requirements related to continuity with our current board; | |

| ● | we are a party to a merger or consolidation that results in our stockholders beneficially owning securities representing: | |

| | ● | 50% or more, but less than 80%, of the combined voting power ordinarily having the right to vote at elections of directors of the surviving corporation, unless such merger was approved by our continuity directors; or |

| | ● | less than 50% of the combined voting power ordinarily having the right to vote at elections of directors of the surviving corporation (regardless of any approval by the continuity directors); or |

| ● | the continuity directors cease to constitute at least a majority of our Board. | |

Effect of Termination of Employment or Other Service

If a participant ceases to be employed by (or provide services to) the Company and all subsidiaries, all of the participant’s incentive awards will terminate as set forth below (unless modified by the Committee in its discretion as described below).